If you haven’t already, join 9,762 other business lovers and subscribe for free:

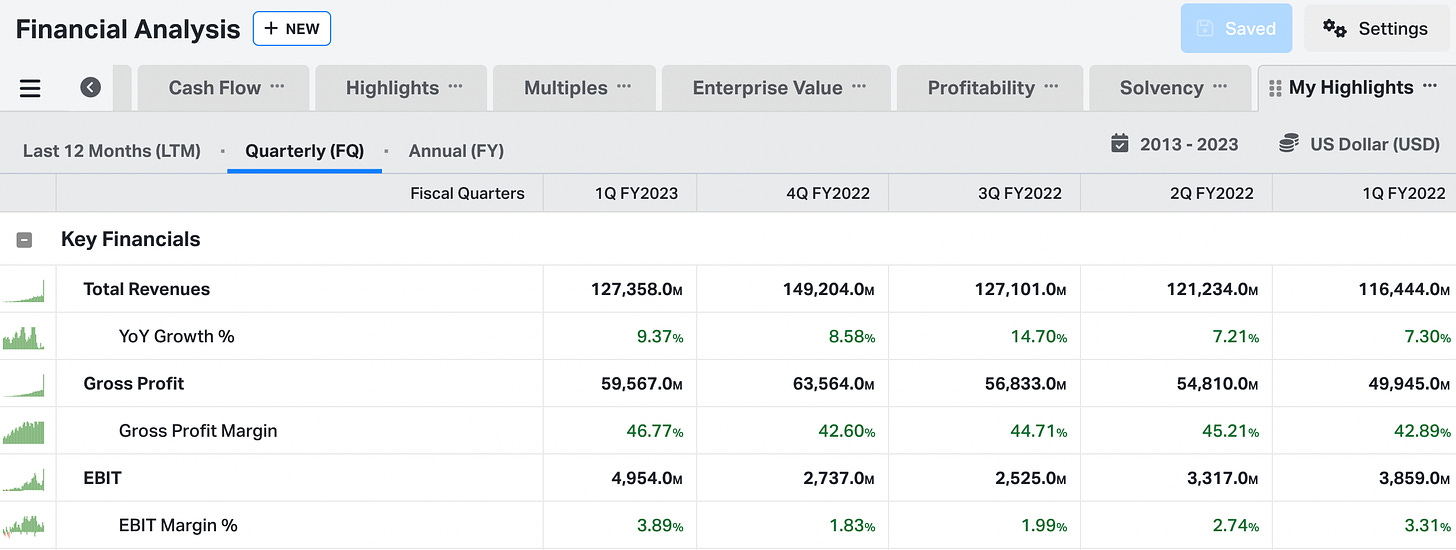

I use Koyfin every day. From staying on top of company news to the most advanced screener you can find, it’s an incredibly good investing tool. My personal favorite is the customized financial templates. Using Koyfin’s shortcuts, I can pull up perfectly formatted metrics for any company in seconds.

I also have a huge watchlist that helps me with earnings dates and finding new transcripts and filings. Rather than having one charting software, one for filings, one for transcripts, and one for financials, Koyfin has it all. And the best part is you can customize it exactly to your preferences. Because you’re a Business Breakdowns reader, use the button below to get 10% off on a plan today!

Origin Story

Celsius is now the third most popular energy drink in the US, behind Monster and Red Bull. And it isn’t slowing down anytime soon. The company is still doubling sales and growth has even re-accelerated a bit since Pepsi became its exclusive supplier and invested $550 million to supercharge distribution. But the path to success hasn’t been a straight line. The company was actually started by Steve Haley in 2004 but had burned through $19 million in cash by 2011 and lost its contract with Costco, wiping out 40% of the company’s revenue. This is what the original packaging looked like.

Haley actually took the company public and even listed it on the NASDAQ in 2008. It was shortly after this that Carl DeSantis’ business partner introduced him to Celsius. He liked the taste and thought there was a space in the market for a science-based healthy energy drink. At this point, DeSantis had just made about $500 million from selling his vitamin and sunscreen business, Rexall Sundown, to Royal Numico for $1.8 billion. DeSantis first invested a couple million in 2008 but a year later, poured in $15 million more, but even that couldn’t quite get the business turned around and they had to delist the stock in 2011. In 2012, DeSantis kicked out Haley and hired Gerry David, an experienced executive, to turnaround the business. And David hired a young CFO, John Fieldly, he knew from Oragenics, the company he left to take the job. Shortly afterward, Chinese billionaire Li Ka-Shing invested about $30 million alongside Russell Simmons, co-founder of Def Jam records. So if you’re scratching your head at this cap table, you’re certainly not the only one.

Here we have the original founder, Steve Haley, who was semi-retired after selling his business, Pivot Point, who got kicked out after 7 years by Carl DeSantis, who had just sold his business. Then the company gets a follow-on from a Chinese billionaire and a hip-hop mogul. And to top it all off, Flo Rida was one of the original ambassadors and recently won an $82 million judgment against Celsius for not paying him in promised stock options. Meanwhile, Celsius is one of the best performing stocks since it relisted on the NASDAQ in 2017, when that young CFO took over the reins as CEO, where he remains. All the while, the company is based in Boca Raton, which probably has the most fraudulent companies per capita. So yeah, it’s not quite your typical multi-bagger.

Differentiation

Celsius packaging now looks like this but the drink is mostly the same.

The company boasts six university studies, detailing the thermogenic properties of the drink. That means that the drink technically increases metabolism and burns calories. Basically, the drink acts more like pre-work out than a normal energy drink.

This is an interesting section in the conclusion section from one of the studies:

It is surprising that, despite prior data that have shown the tested beverage to elicit increases in resting energy expenditure and free fatty acids when consumed acutely or for 28 days (9,25), the current study found no benefit on measures of body composition in subjects that just consumed the drink for 70 days. However, when the energy drink was consumed daily and combined with, and ingested 15 minutes prior to, exercise, significant improvements in body composition and cardiorespiratory fitness were observed. More interesting is that the observed changes occurred despite no modifications being made to the subjects’ diets, there were no significant differences between groups for total caloric intake, and total aerobic training volume between the 2 exercise groups allowed for minimal variance. Thus, it could be suggested that consuming Celsius prior to regular exercise in previously sedentary, overweight men may yield more significant body composition and cardiorespiratory improvements than exercise alone.

That sounds a lot like pre-work out. What I can tell you is that most consumers aren’t buying Celsius because it has six university studies with somewhat questionable conclusions. It’s all about branding in this space. And Celsius is the “healthy” brand, capturing the zeitgeist of this moment.

The Numbers

If you would’ve told me that Celsius would go on to be solidly profitable in this incredibly crowded space, growing from $5 million in 2008 to well over $1.2 billion in sales next year, with this crazy cap table in Boca Raton, I would’ve told you that you’re crazy. But such is life. Sometimes the best stories are the most improbable ones. And it’s a good lesson to not overthink things sometimes and just follow the numbers. Because those have been downright impressive.

In fact, from 2015 to 2022, sales grew at an unbelievable 68% CAGR and if we estimate 95% growth for 2023, that CAGR actually bumps up to more like 71%. That is up there with the early part of Shopify’s S-curve. Rare air, indeed.

Moreover, the company is GAAP profitable and could do $200 million in EBITDA this year, maintaining mid-40% gross margins.

Currently, Monster does $6.5 billion in revenue compared to Celsius’ $780 million, so Monster is more than 8x bigger right now. By year end, it’s quite possible that Monster does $7 billion in revenue and Celsius does $1.2 billion, cutting the gap from 8.3x to 5.8x in just 3 quarters. And if you look at the latest Nielsen data, Celsius is growing wekk over 100% and Monster is sort of flat.

It’s kind of crazy, but if you extrapolate out a couple years, I don’t see why Celsius couldn’t do more in sales than Monster. This might be the stock’s momentum talking but it does seem to appeal to a greater audience. Celsius is branded as “healthy” and doesn’t have the same extreme sports demographic that Monster and Red Bull do. I think that inherently widens the market as not everyone is into extreme sports like motocross or jumping out of a helicopter in a squirrel suit.

Competition/Advantages

And the Pepsi deal has really accelerated distribution. Monster is backed by Coke’s distribution so Celsius is the one that Pepsi has decided to support. In short, Celsius is Pepsi’s way of competing in the energy category with Coca-Cola. It’s no surprise that Monster recently launched Monster Zero Ultra, with no sugar. However, the brand that the company has built over the past several decades can’t pivot overnight. Celsius is becoming the cognitive referent for a healthy energy drink. That isn’t necessarily a stable moat but it’s certainly working for the time being. On Amazon, Celsius has 19% share compared to 26% for Monster and 12% for Red Bull. But in terms of overall market share, Celsius is in third place, with 8%. To add more context, in south Florida, Celsius has 21% market share (thanks Flo Rida). So if we look at some of these data points, Celsius can still gain quite a bit of market share, and possibly even overtake Monster at some point.

Now the real question is the durability of something like this. Celsius has been able to grow so fast and energy drinks are an incredibly crowded space. One reason why is the downfall of energy drink company, Bang. It was quickly nipping at the heels of Red Bull and Monster before Monster sued the company in 2018 over its false advertising of being made with “super creatine.” A jury ruled in favor of Monster and now Bang is filing Chapter 11 bankruptcy, after having to pay out nearly $300 million to Monster. And to top it all off, Monster is pulling the ultimate savage move and buying Bang’s assets now. But the fact that Bang could grow so quickly – it was founded in 2012 – and fall so fast may be a testament to the moat, or lack thereof, here. Monster isn’t going to lay down and play nice with Celsius, but the fact that the latter now has the Pepsi distribution muscle is very important.

Bang has been hemorrhaging market share and Celsius has been scooping it right up. One problem is that there are so many competitors that enter the market every year. While the energy drink category is still growing, it’s hard to say whether Celsius has real staying power. I was wrong on Monster after all these years and it was one of the best performing stocks out there. And maybe that’s why this type of company tends to outperform wildly. Because the first level thinking doesn’t see a moat at all so the valuation starts out reasonable but the numbers keep grinding higher and therefore so does the stock price.

Conclusion

I don’t personally see a deep moat with Celsius but you can’t deny the execution of the company. Fieldly has done an amazing job and the company has a real advantage of its healthy brand. We could debate the difference between sugar and sucralose till the cows come home, but Pepsi believes in the company and sales are profitably doubling. Sometimes that’s all that really matters in the short run. Riding the S-curve may very well be profitable for investors but I would caution against buying and forgetting this type of company.

If you enjoyed this, please turn that ♡ into a ♥️. This will help others find this newsletter. Thank you so much 😁

What Else We Offer

For self-directed investors: Dynasty Membership

Long-biased fund: Infuse Partners (intro call)

More content (The Investing City Podcast, online course, and blog)

If you’re interested in advertising, just fill out this form