If you haven’t already, join 9,475 other business lovers and subscribe for free:

Today’s post is sponsored by Stratosphere.io. It’s a financial data platform that we use and it’s awesome for gathering and visualizing financial data for any company you’re researching.

Get started researching on the Stratosphere.io platform today, for free. And you can use the promo code: investingcity for 25% off your first year.

“I have ten different services that are growing all the time. Think of us as the local sewer system.”

Well, that got his attention.

“We’re a utility. Nothing can get rid of us – nothing. Two of the biggest businesses in the world are car manufacturers and insurance companies,” I went on. ” If insurance companies don’t write insurance policies on cars, then they’re out of business. If manufacturers don’t make cars, then they’re out of business. They’re always gonna make cars and they’re always gonna insure them. We’re the guys in between.

As long as we’ve got the land in the right place to put the cars on, we can’t fail. We are like the septic tanks of the sewer system. You can’t have the system without us.” – Junk to Gold, pg. 94-9

QUESTION: What happens to a totaled car?

There are many areas in life where people don’t know what they don’t know. There are many examples of this. However, I would argue the overwhelming majority of people have absolutely no idea what happens to a car after it’s declared totaled. Neither did I until I started researching this company!

After declaring a car totaled, there is a process that involves inspecting the car for damages, towing the vehicle to a scrap yard, either fixing it or dismantling it, and then putting the vehicles up for auctions that occur on a global scale. Also, there are only two companies (a duopoly) that can compete in this industry because of a hidden arms race to get to physical scale, that was fought three decades ago.

Since going public near the start of this little known arms race, Copart (Ticker: $CPRT) has trounced the S&P500 and returned over 24,000%, compared to the S&P500’s 783%. Now, I would not expect these style returns in the future, as I will cover later. However, I will go into why the company’s dominant advantages will continue to deliver consistent returns.

Willis Johnson: The Early Days

The quote at the beginning of this post is from the book Junk to Gold, which is about Willis Johnson, the founder of Copart. If you’re interested in the company, you need to read the book! I will try to cover the story of the company though from a high level, try not to spoil the book, attempt to provide some value, and give you a well rounded view of the company. Let’s get into it!

Willis Johnson founded Copart in 1982 out of a single scrap yard in Vallejo, California. Before this time, Willis had been in the scrap business for years. He had dismantled cars, sold and resold salvage parts, processed sales of metal scrap, and a had variety of other endeavors. Over the next few years, he began purchasing a few more scrap yards and implementing his own approach at the acquired business. His yards had inventory trackers (big deal in 80s), organized clean lots, and insurance customers. These insurance companies partners with Copart to recoup portions of their loses after vehicles in accidents were deemed less than their salvage value.

One of Copart’s competitors, Insurance Auto Auctions (IAA), went public in the early 80’s and started purchasing scrap yards across California. Willis decided he needed to go public as well and compete with the rival head on. Over the next decade, both companies expanded outside California, conducted overlapping bidding wars, and became the two major players in the business. Then, everything changed again with this small new invention… the World Wide Web. More on that later though!

The Business Model

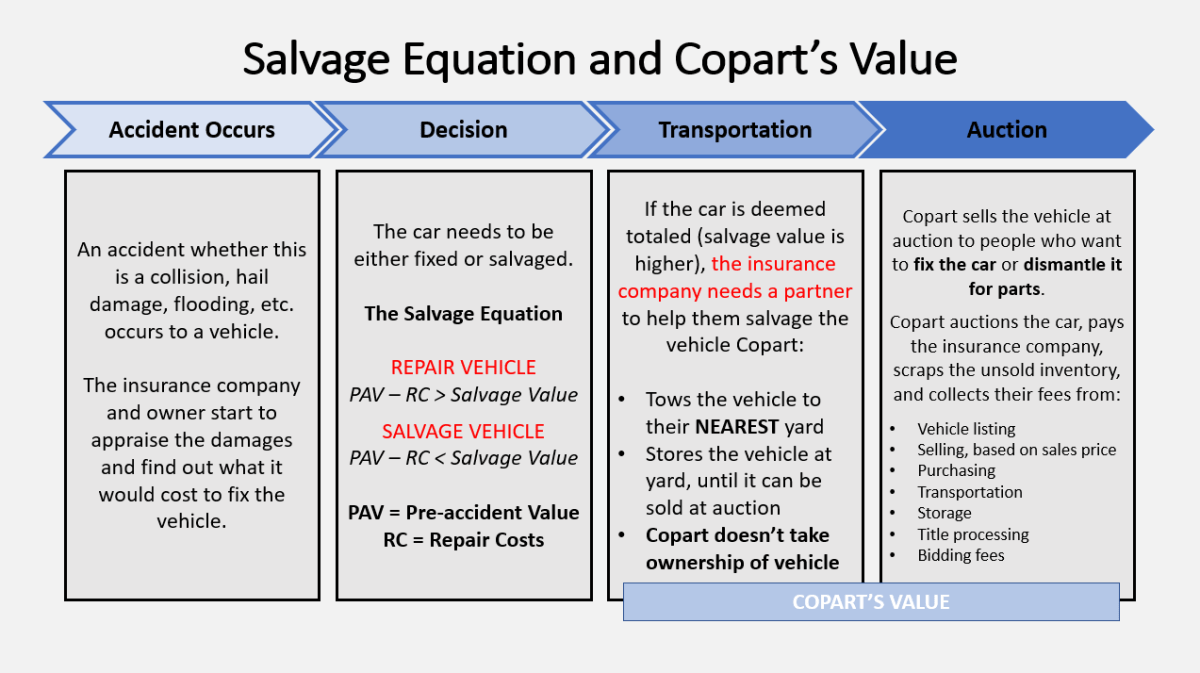

Before going into the impacts of the Internet on Copart’s business, I still need to clearly walk through the business model. Below, I go over the two major aspects to this business model: The Salvage Equation and Copart’s value.

Finally, I attached one of Copart’s slides that explain this concept from their latest Investor Presentation… in 2015.

Copart Investor Presentation 2015, Slide 6

Copart makes their money by providing services all the way from coordinating the towing of the vehicle (subcontracted out), storage, listing, processing fees (buyer and seller), bidding fees, title insurance, and scrapping unusable inventory. Essentially, it’s recycling for the car industry.

Now, you understand why Willis Johnson described the company as “a sewer system”. Insurance companies need to write policies for cars and are looking to minimizing their losses after each accident. Auto manufacturers need Insurance companies to insure their vehicles. There just needs to be someone to get rid of the waste.

Where are these cars being sold though? They are being sold to individuals dismantling vehicles, fixing them up for themselves, or international buyers. In particular, the international buyers make up the large majority of transactions. These international buyers can ship the cars internationally, fix them to the standards of the destination country, and still make money on the transaction.

Scale Advantages: Physical Network Effect and the Internet

Copart has one of the most intelligent shareholder bases I’ve come across. First, investors need to understand the necessity of the business model for the industry. Secondly, they need to understand how the scale advantages work within the industry, providing Copart with a near impenetrable moat.

Network effects are defined as a phenomenon whereby a product or service gains additional value as more people use it. In this case though, we’re talking about scrap yards and auctions. The questions are these… how does adding another scrap yard provide more value to the already existing base of scrap yards? Why were IAA and Copart racing to acquire as many scrap yards as fast as possible? How does the internet change this business model? Can any other entrants come for IAA and Copart’s duopoly title?

In the 1990s, Copart and IAA were aggressively buying scrap yards to achieve scale. This was due to three main reasons:

Lower costs: Copart made the decision to eventually subcontract out their towing services. This meant that, if the scrap yards were further from an accident, towing fees would start to eat into the bottom line. This meant that having a higher density of yards allowed each company to lower costs for each additional yard, creating a situation with return on incremental invested capital (ROIIC). In the early days if a yard had too high of expenses, another yard would be purchased in the same area to lower costs and increase the bottom line.

Aggregated buyers: Originally, Copart had in-person auctions. This meant that the buyers had to be there in person to make a bid on the vehicle. The internet changed this. In 1996, Copart created their company’s website and started uploading pictures of each vehicle. Then in 2003, the company went 100% online on their bidding platform. This meant that individuals from all over the US, and the world, could bid on Copart’s platform. This increased the sale price of the vehicles by increasing the number of people that can bid on available inventory without being at the yard itself, creating a two sided network (similar to Facebook but for scrap vehicles).

In respect to international buyers, “For fiscal 2021, sales of U.S. vehicles, on a unit basis, to members registered outside the state where the vehicle was located accounted for 64.1% of total vehicles sold; of which 29.7% of vehicles were sold to out of state members within the U.S. and 34.4% were sold to International members, based on the IP address utilized during the auction process” – Copart 2021 10k

National contracts: After operating more locations, Copart and IAA also negotiated national contracts with Insurance companies. Insurance companies are less likely to go with multiple smaller regional providers due to integration purposes, higher costs, and more effort.

It’s nearly impossible for another entrant to enter the market today. Even with substantial amounts of money, they would need to (1) purchase tons of land near a significant number of metropolitan areas AND manage to create a dense network (2) steal market share for buyers on a platform (3) operate their scrap yards efficiently (4) ink deals with insurance agencies in the meantime (taking business from Copart/IAA) while getting to scale (5) somehow get permits for this quickly before cash runs out.

The last one weirdly enough is probably the most difficult. Copart and IAA have trouble expanding themselves and getting new scrap yards in good locations. As metropolitan areas have grown, their land has become more valuable with its location. A new entrant today, even if with infinite capital, would have trouble getting cities to permit them building multiple new scrap yards.

Management (Copart vs IAA)

Speaking of memes and the internet, who was the mastermind at Copart though who had the idea to launch Copart’s website in 1996 and even thought to try to purchase IAA.com, as a joke? (Was taken by a furniture store) The answer is Jayson (Jay) Adair, the current CEO of Copart, who took over for Willis Johnson. Willis also happens to be Jay’s Father-in-Law! When Jay was 19, he started working at Copart and learned the industry under Willis.

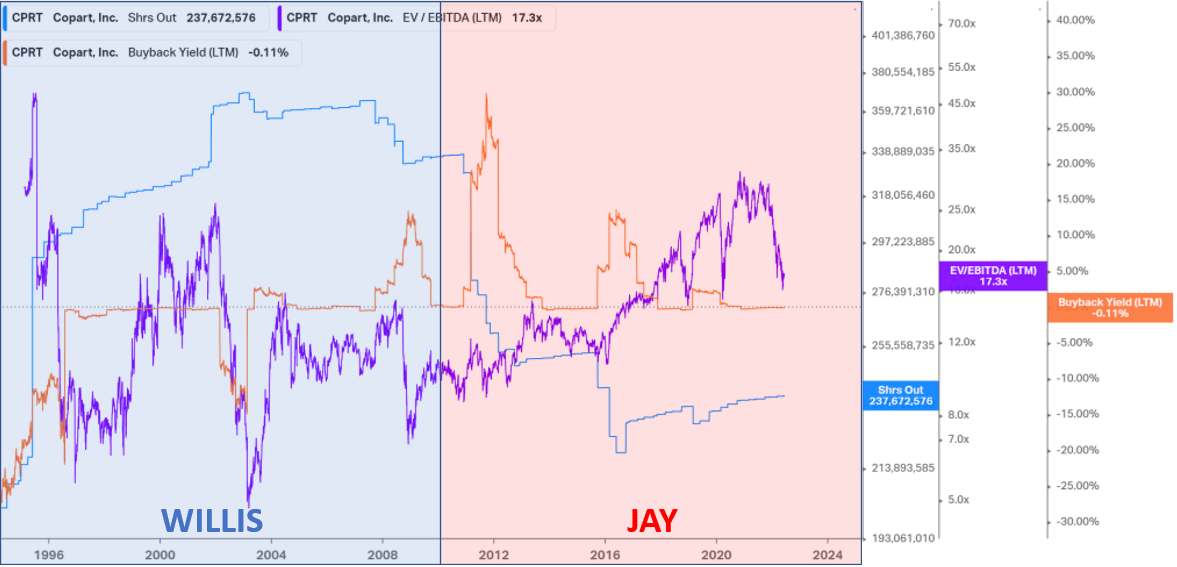

Both CEO’s are amazing in their own way. Willis had the discipline to create a business from scratch, make hard decisions about what their business model was, and put a masterclass quality team in place. In 2010, after working at the company for 21 years, Jay Adair became the CEO of Copart.

Both executives have been conservative in their management approaches to growth and capital allocation. In the early days, debt was not utilized to grow the business’ scrap yard portfolio. Willis preferred to issue stock and raise capital via share issuances. In the end, it allowed the company to reach scale in a business that had a durable business model. Unlike many companies today that utilize their shares, Copart reached scale and stopped the excessive dilution.

Growth and Capital Allocation

Copart’s capital allocation strategy is pretty simple.

Acquire additional yards to storage more vehicles, domestically and abroad

Expand current locations to handle greater capacity

Pursue more global, national, and regional selling agreements with Insurance companies

Increase service offerings

Increase offerings to outside of automotive: Boats, Motorcycles, etc.

Start to sell vehicles outside of totaled vehicles (80% of vehicles are totaled through insurance today)

Occasionally buyback a large number of shares at good prices

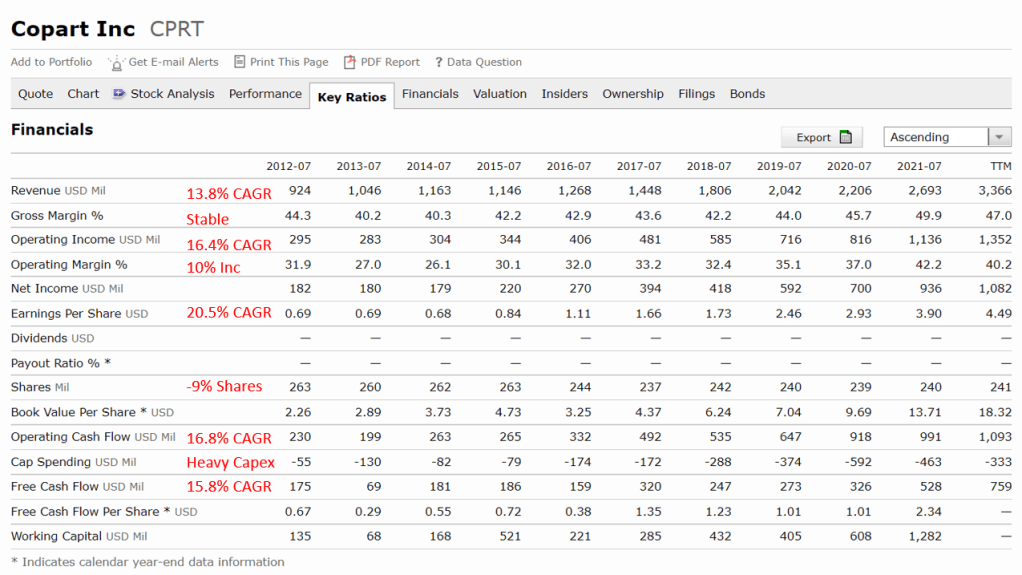

That’s it really… once you understand the underlying business, the growth options are clear. It also makes sense why the company has consistent growth, stable margins, and has pretty heavy Capital Expenditures. The heavy Capex coming from expanding their capacity via acquisitions, purchasing land, and expanding their existing yard capacity. It’s worth mentioning, Copart also tends to purchase their land, rather than lease, which provides strategic advantages over the long term (IAA leases).

This is another example about the company remaining conservative over the years. It also means their book value has been growing quite fast and their operating margins are ridiculously high.

The foreign expansion has been going relatively well. Since the initial expansion into Canada in 2003, the expansion to new countries has been slow and steady:

Canada in 2003

UK in 2007, 2008

UAE, Brazil, Germany, Spain in 2013

Bahrain, Oman in 2015

Ireland, India in 2016

Finland in 2018

Since 2019, Copart has opened/acquired 2 operational facilities in Brazil, 10 in Germany, and 26 in the United States. Longer term, Copart is looking to expand to India and China.

The foreign market does have differences with insurance policies. In foreign markets, Copart is currently needing to purchase the vehicles initially and prove the concept. Eventually, the goal is for Copart to never own the vehicle internationally as well.

Financials and Capital Allocation

Clearly, over the past 10 years Copart has done quite well. They have managed to grow their topline at a consistent pace. In 2021 and 2022 (TTM, Q4 in September), the company has put up some amazing growth numbers with revenue growing 22% and 25% respectively. This is clearly much faster than previous years with auto inventory shortages and a high demand for used vehicles.

In the past 10 years, Copart has managed to grow their operating margins nearly 10 percentage points with gross margins only increasing a few percentage points. Currently, their conversion from gross profit to operating profit is a very mature and an impressive 85% conversion. However, this means without gross margin growth, Copart will most likely not be able to grow the bottom line as fast the next 10 years.

That being said… the company could focus on their per-share metrics instead with large share repurchases. Below, I created this chart with Copart’s shares outstanding, their historical valuation, and their buyback yield when they repurchase shares.

I see this chart and I see the initial share issuance phase (Willis’ tenure) to acquire scale. Then, there is the capital return phase (Jay’s tenure) where the company started aggressively repurchasing during 2008, 2011-2012, and 2016. Notice how in a few short years during the GFC and its aftermath, the company reduced the shares outstanding from 370M to 250M (-32%). Also, they quit repurchasing when the valuation increased.

That’s good capital allocation.

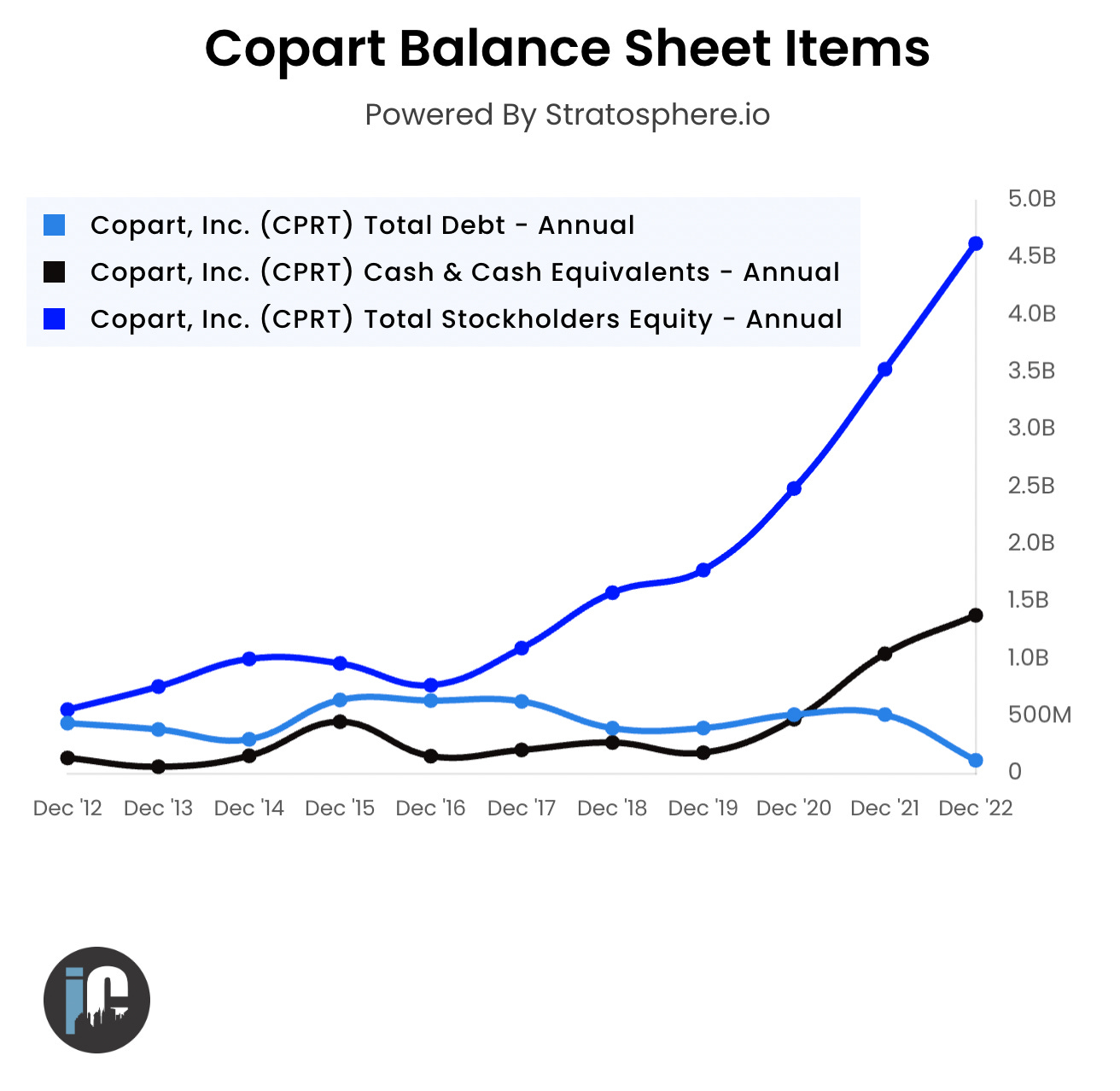

Today, Copart sits with a fortress balance sheet going into this uncertain macro environment. Operating income ($1.35B) is over 2x their Total Debt. Cash on hand is equal to nearly 6% of their market cap. The company is definitely well prepared to take advantage of any depressed stock price and tough macro environment.

Investment Opportunity Today

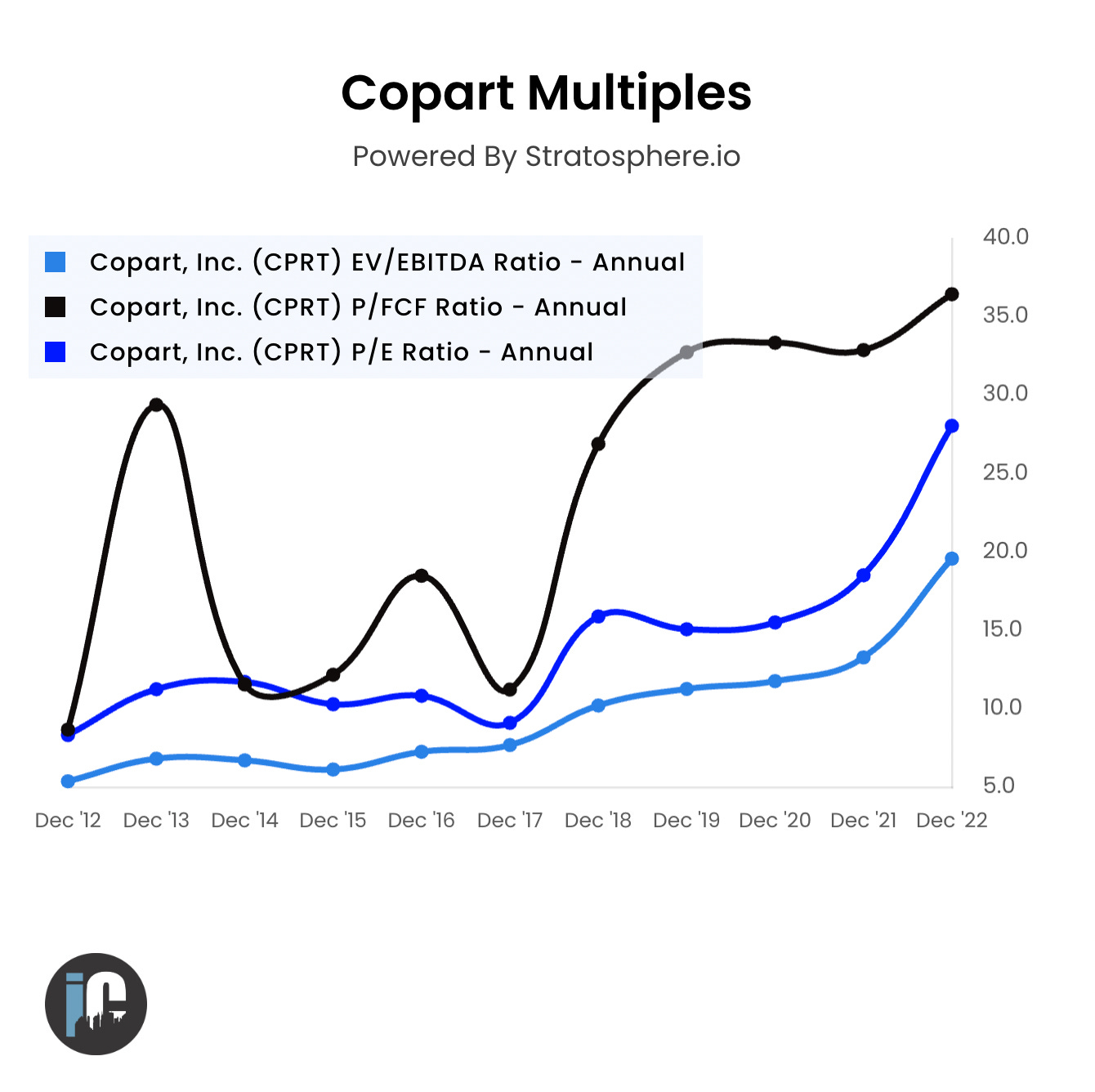

I haven’t built any in-depth models on this name. It is clearly still much more expensive than it has been in the past. However, just because something is expensive doesn’t mean it can’t produce a sufficient return on investment. It just makes it significantly harder.

Today Copart sits at the following:

Market Cap: $35B

Diluted Shares Outstanding: 477M

Price per Share: ~$74

EV/EBITDA: 21x

Price/Earnings: 31x

Price/FCF: 37x

I know this is cliché but… it’s a pretty rich price to pay here. From the end of 2012’s FY (Sept. 2012), Copart has delivered around a 930% gain to shareholders (26% CAGR).

That is all backwards looking though, what can we expect going forward? Revenue growth will most likely be slower or similar, even with international opportunities. Car prices and salvage values will increase significantly (high inflation). Valuation multiples will most likely be lower than the last decade (buybacks?). Operating margins and net income margins are mature here (85% gross profit translates to operating income), and the company’s core business will remain relatively stable.

This is an amazing company. It has one of the widest moats of any business in the world today, a solidified duopoly with a weakened IAA recently, is growing steadily, and trades at a premium for that. Below are some of the risks that I found to be most relevant. Most of them deal with the growth rate though, which I feel we accounted for in our assumptions.

Risks

The expansion strategy might not take off, whether this being due to insurance policies in other countries, regulatory concerns, or not being able to implement the online model with the same synergies as the US, Canada, and the U.K.

Electric Vehicles and IAA: Outsourcing this analysis to a blogger named YHamilton (Twitter: @YHamiltonBlog), who writes the Substack “Analyzing Good Businesses“. Terrific follow! Click HERE for his analysis.

Failure to maintain proper capacity at big events like Hurricane Katrina, Harvey, etc.

Not being able to complete sufficient acquisitions to grow at the same rate as the past

Summary

I feel like I learned a lot researching this company. It cemented in my mind what a truly impenetrable business looks like. I think that our assumptions on forward returns can be tweaked, and you could totally squint at it with your head sideways and find a 15-20% CAGR. However, this opportunity is not right for me currently.

If I were to be given Copart versus the market today looking past 5 years, I’d choose Copart. In respect to Risk/Reward though, there are tons of companies I’m looking at with much higher Reward potential, but there are not many companies that have a lower Risk profile.

Thanks so much for reading! We appreciate you! If you enjoyed this, please consider pressing that ♡ below to make it ♥️. This will help other readers find this newsletter. Further, if we get 50 ♥️s on a post, we will randomly select a subscriber to receive a $50 Amazon gift card.

What Else We Offer

Our full-service research offering: Dynasty Membership

Our accredited investor long-biased fund: Infuse Partners (intro call)

More Investing City content (The Investing City Podcast, blog, videos, etc.)

Excellent, in-depth analysis. CPRT business is certainly outstanding. But the question is, at 31x is there sufficient margin of safety for new investors?