If you haven’t heard, we just tore down the pay-wall on Business Breakdowns to make it a free newsletter. As part of the re-launch, we’re rolling out our formerly paid articles over the next several months so sign-up if you’d like to get hit with an avalanche of free business analysis!

Costco is a fascinating business. You know all those groceries you buy? Yeah, they basically sell those at breakeven and then make all of their profit from the $60 annual membership fees.

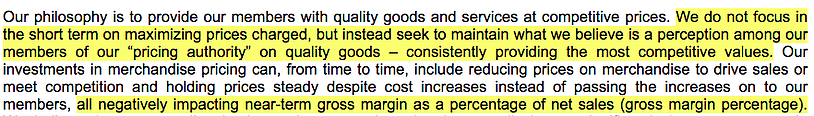

The key is that the company keeps gross margins as low as possible. This, in turn, gives Costco pricing authority. In other words, you don't even look at the price because you know it's going to be the best. The company can do this through its meticulous merchandise sourcing. If you've ever been to a store, you've probably noticed Costco doesn't have much variety. As evidence, the company usually keeps 4,000 SKUs (stock-keeping units, or the number of different products) versus Walmart's 100,000. This narrow focus allows the company to have more leverage over its suppliers since volumes are so large.

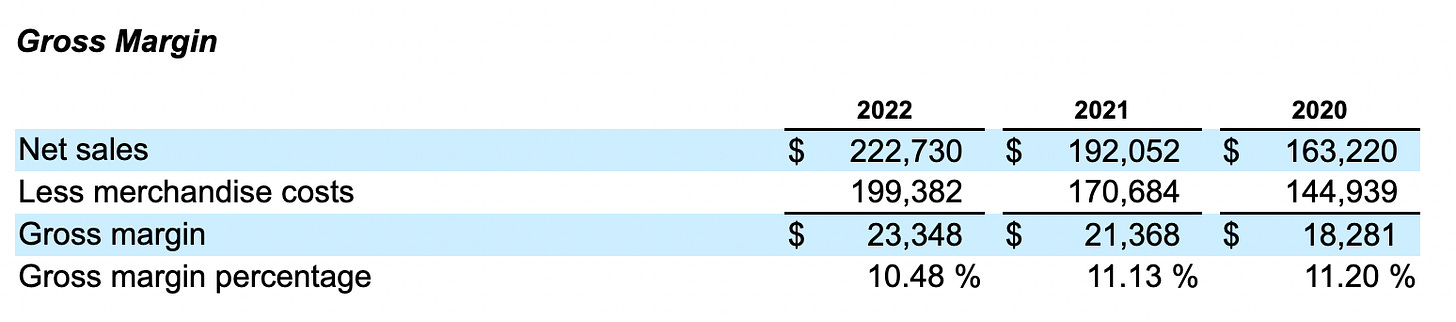

For merchandise, Costco's gross margins are only 11%. So when you buy 5 lbs. of peanut butter for $10, it costs the company $9 typically. Or when you buy 4 shampoos for $15, it costs the company about $13.50.

You get the idea.

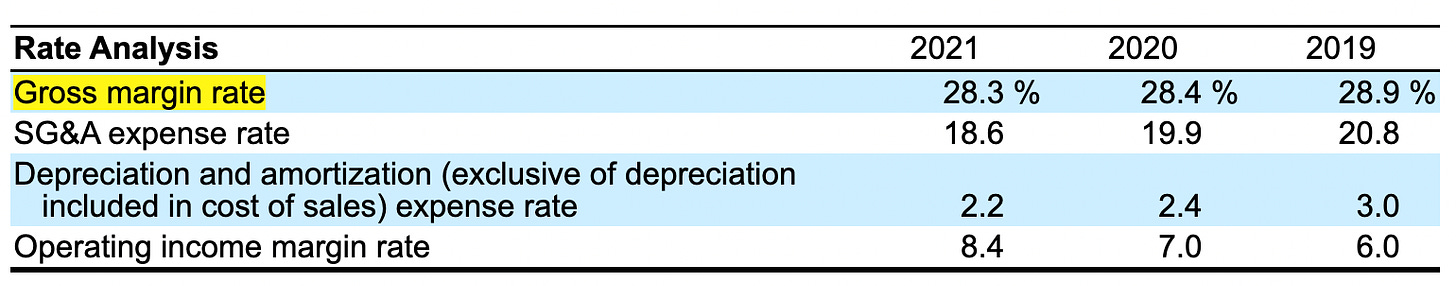

Compare these gross margins to Target's, at almost 30%.

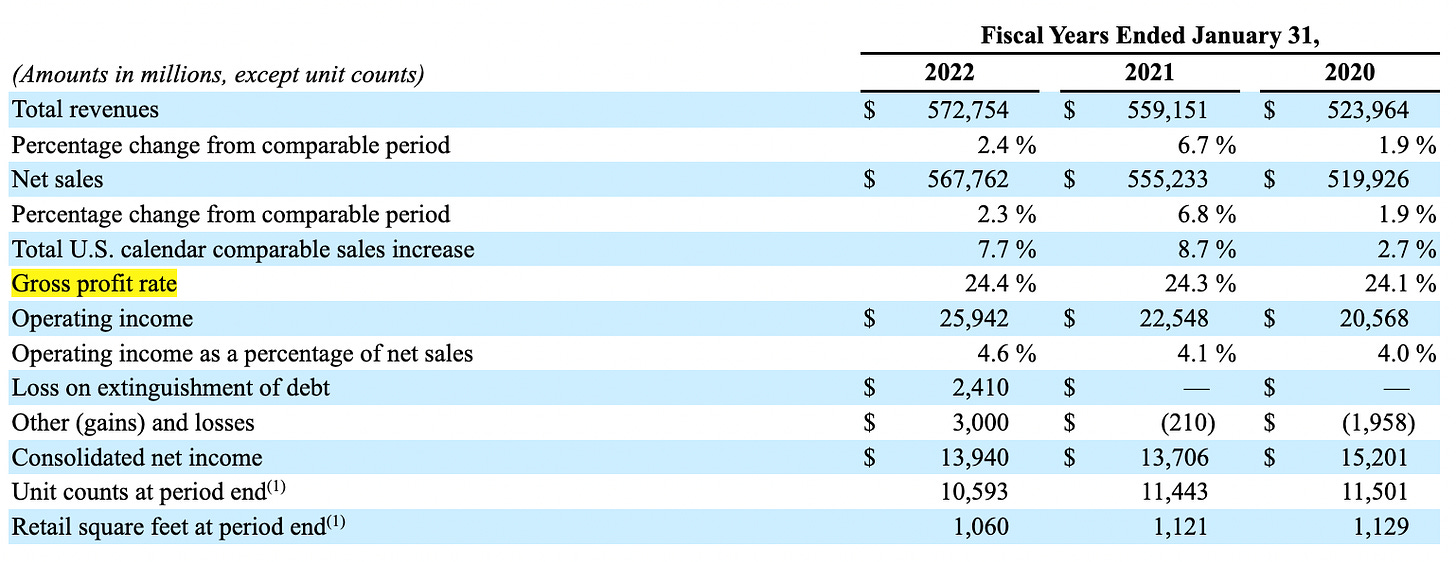

Or against Walmart's gross margins, at about 25%.

This means the same 5 lbs. of peanut butter that costs $10 at Costco, would cost around $11.50 at Target and $11.25 at Walmart.

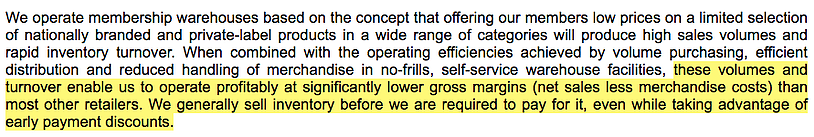

Further, Costco typically sells its inventory before it needs to pay suppliers.

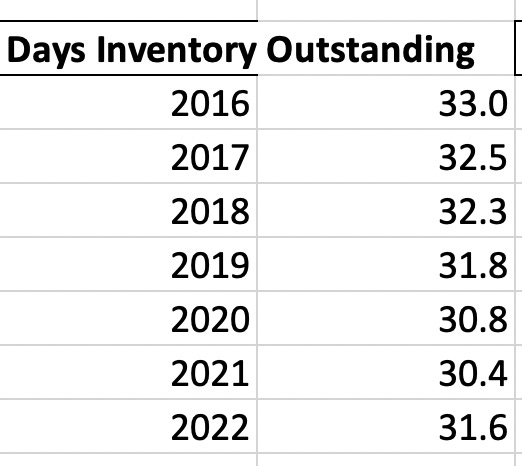

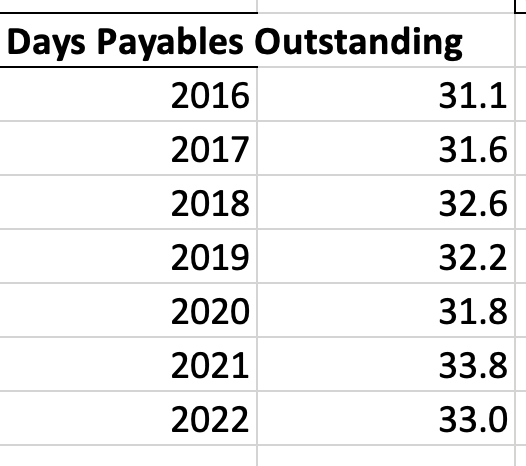

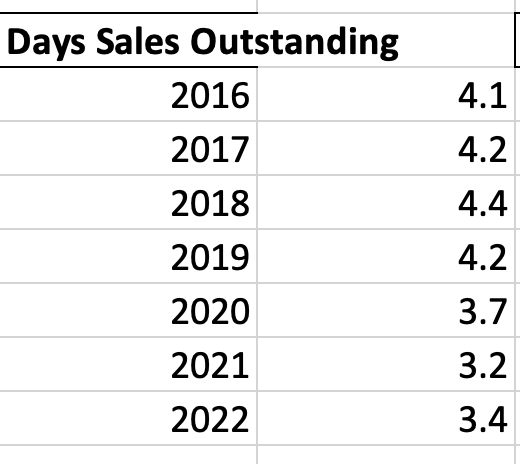

Costco has essentially aggregated demand which it can then leverage against its suppliers in the form of payment terms. See, the days inventory outstanding (DIO) and days payable outstanding (DPO) are basically the same (just over a month). On top of this, Costco collects cash in 3-4 days. Since it is doing such high volumes, it also has bargaining power with Visa and Citi bank so receivables are less than 1% of revenue.

This means that in 2022, Costco's cash conversion cycle was just 2 days. So in 2 days, Costco goes from inventory to cash in the bank account. This is because the company only keeps about a month of inventory on hand, gets cash in 3 days from their Visa credit card relationship and then takes 33 days to pay suppliers. While its cash conversion cycle is not negative like Amazon, it is an outlier in terms of how low it is for physical retailers.

Some retailers have cash conversion cycles upwards of 40 days. In this particular case, Costco would have a 38-day advantage to buy more inventory and make more sales.

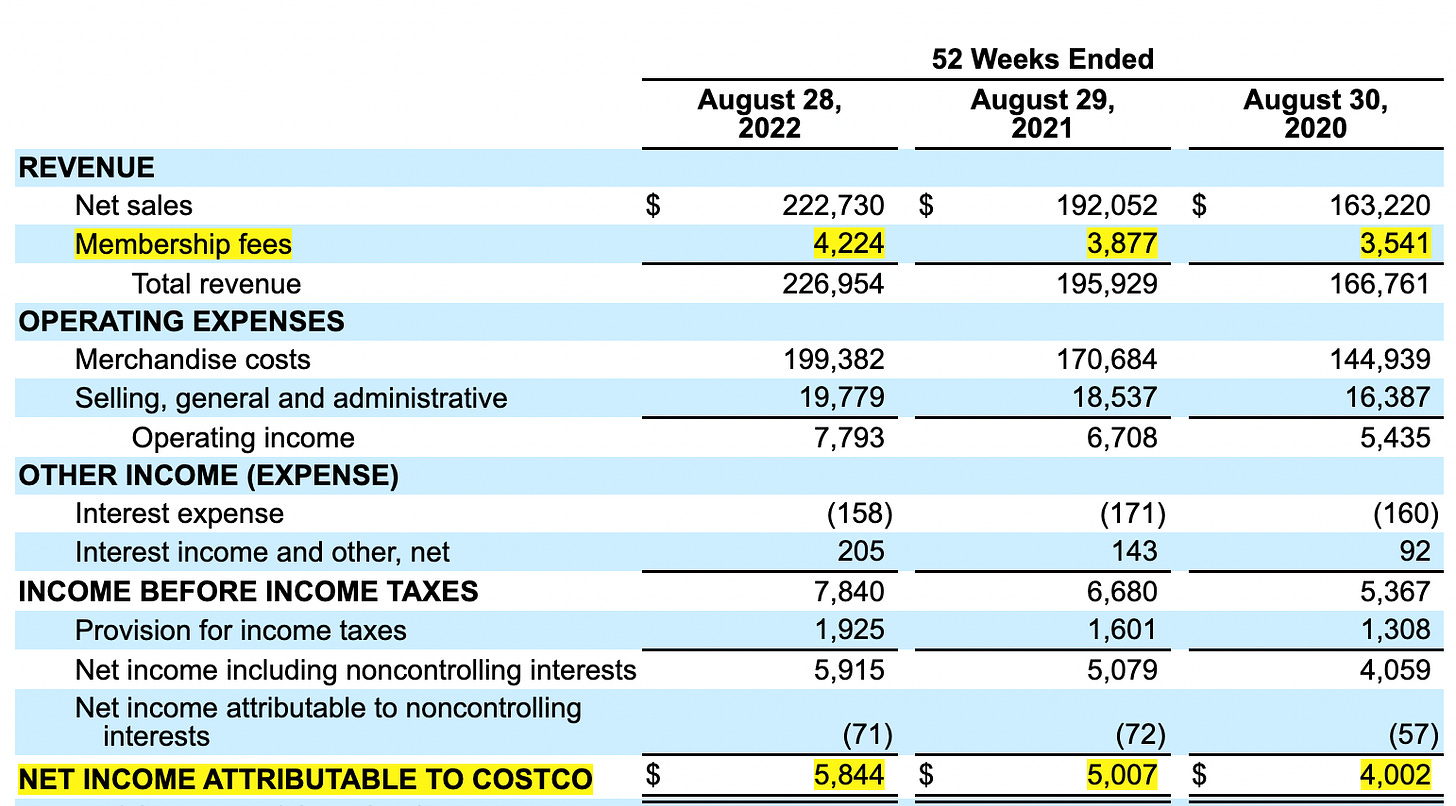

Now for real kicker. Look at the percentage of net income that comes from membership fees.

How’s that for similar?

Let's take 2020 for example. Net income was about $4 billion and membership fees were $3.5 billion. So even though membership fees only made up 2% of overall sales, they made up 88% of net income.

The company has nearly 66 million paid members of which 37% are executive members. This roughly equals the $4.3 billion in membership fees for 2022. Executive members pay an extra $60 annually but receive additional cash-back savings.

All in all, Costco's business model is to sell products for as low a margin as possible to aggregate demand which they can leverage against suppliers and collect cash from membership fees. And then the cycle repeats.

It's no wonder it can sell a hot dog and a soft drink for $1.50! That's not where the real money is made!

It would be great if you could mention the valuation of costco, as well. It is basically too expensive

Price to Cash Flow Per Share of 29 is too high compared to industry. Is it because they collect cash in a few days?

I agree that this is a great post. So effortlessly and succinctly illustrates a concept which I was completely blind to.