If you haven’t already, join 9,884 other business lovers and subscribe for free:

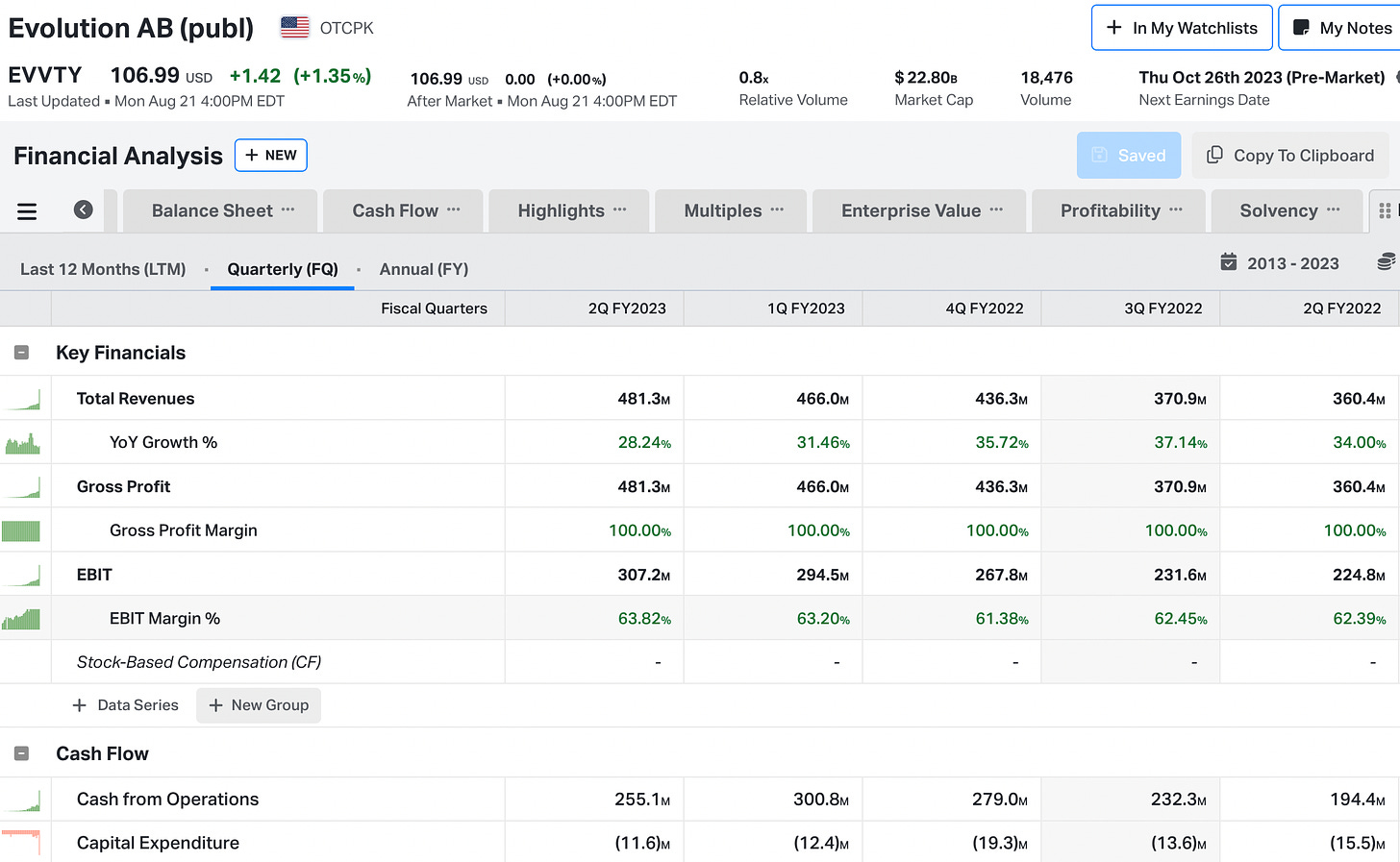

I use Koyfin every day. From staying on top of company news to the most advanced screener you can find, it’s an incredibly good investing tool. My personal favorite is the customized financial templates. Using Koyfin’s shortcuts, I can pull up revenue, gross profit, EBIT, FCF, net debt, goodwill, ROIC, and working capital dynamics for any company in seconds.

I also have a huge watchlist that helps me with earnings dates and allows me to easily find new transcripts and filings. Rather than having one charting software, one for filings, one for transcripts, and one for financials, Koyfin has it all. And the best part is you can customize it exactly to your preferences. I rarely am passionate about investing products but this is one I strongly believe in. Because you’re a Business Breakdowns reader, use the button below to get 10% off on a plan today!

Overview

Evolution Gaming does the back-end stuff for online gambling games. You can think of it like Shopify but for very established casino players. For instance, 888 Casino uses Evolution for Live Blackjack, Roulette and Poker. If you want to get an idea of what that actually looks like, check out this video (be warned that the background music is a tad intense).

The company's main bread-and-butter is live casino. Players can sign on using their phone (69% of usage), tablet or desktop and start making bets in real-time. The advantage of "live" are two-fold. One, it makes the experience feel fairer. If you're playing a computer-generated competitor, losing a bunch of times in a row feels rigged. But if you can see a real dealer and know that real people are on the other end of your bets, the whole thing just feels better to players. Two, it's way more engaging. Having a real, human dealer and time limits make things much more interesting.

Live casino accounts for 84% of Evolution's revenue and the remainder is RNG games (random number generated). The live casino umbrella also includes live game shows like MONOPOLY and Deal or No Deal. RNG games are basically online slot machines. These are not live but they can be engaging. For example, check out this Gordon Ramsay Hell's Kitchen slot game. Keen observers of that video may have noticed that the Hell's Kitchen video was created by a company named NetEnt. Evolution bought NetEnt in September 2020 for $2.1 billion because they are a leader in video RNG games. One thing you need to know is that NetEnt was struggling to grow before buying Red Tiger in September 2019 for $220 million. In essence, Evolution's acquisition was sort of a two-in-one deal since NetEnt had taken over Red Tiger just a year earlier. Evolution has done a good amount of these IP acquisitions but the company also continues to innovate on its own; it’s Crazy Coin Flip game is the first live slot machine game it has released and it combines the engagement of live with the addictive nature of slots.

Sizing the Market

While Evolution is clearly the leader in live casino, RNG games provide another growth avenue amidst the large and growing online casino market. Currently, the global online casino market is roughly a $60 billion market. Within this, live casino is around 25% of the market, at a $15 billion revenue opportunity. The reason why Evolution is making such strong moves into RNG is because the market size is more than twice as large as live casino at ~$35 billion. So while RNG only makes up 16% of Evolution's revenue, it likely has a longer runway. I say "likely" because the live casino market has grown at 28% for the last 4 years while RNG has only grown around 9%. If those growth rates are maintained, live casino could surpass RNG in roughly 8-9 years. If that happens, then the online casino industry will have grown to over $100 billion. Unbelievably, the total global gambling market is worth $500 billion so it might be reasonable than in about a decade, online casino makes up 15-20% of the total revenue pie.

Layer on top of this the fact that only 60% of Evolution's business is regulated (meaning online gambling is completely legal) and you begin to see that the market could continue to expand. Interestingly, that 60% is basically Europe while non-European countries are starting to get on-board. In the US, for example, only New Jersey, Pennsylvania, Michigan, Nevada (of course), Delaware and West Virginia have fully legalized online gambling. Unsurprisingly, Evolution has a few studios in New Jersey and Pennsylvania and built one in Michigan last year.

Now, let’s tie in the revenue opportunity with the business model. Saying the US e-commerce market is more than $1 trillion and then thinking Shopify could capture all of that would be missing the business model completely since revenue and GMV are obviously VERY different. Same goes for Evolution. The company makes money by charging a fee based on the operators winnings.

From talking to people in the industry, it's anywhere from 10-15%. So if we use the current $15 billion live casino market and the upper end of our range (15%), that's a $2.3 billion revenue opportunity. Seeing that Evolution did $1.5 billion in TTM live revenue that means Evolution is roughly 65% penetrated globally. First of all, that's some serious market share – respect. Second of all, it's easier to see why the company is rapidly moving into RNG where it only has about 9% market share. Regarding live casino, it's basically a bet that the market will continue to grow as a proportion of total online casino. Right now, it's 25% but it could go higher if Sweden's live casino market (where Evolution was founded, not coincidentally) is any indication at a 60% penetration rate.

At any rate, I think market size for live casino is definitely something to keep in mind. Market share is really a two-edged sword. On one hand, it means the market leader has scale which allows them to re-invest back into the business much more aggressively than small competitors. And Evolution has done just that, earning it the reputation of having the best studios and technology. On the other hand, as Evolution improves its product, it grows the market itself. While it’s important to have the market backdrop, the best companies tend to grow their own markets as great products unlock latent demand.

Business Model

If you didn't watch the video at the beginning, understanding what Evolution actually does to earn their 15% might be a little confusing. They set up actual, live studios with real dealers who are being filmed at then streamed out to everyone who is playing the game. In fact, Evolution also has a dedicated table package where brands can have the dealers wear their swag and have branded poker chips or roulette tables. Evolution charges operators a little more for this experience.

The other question that might come to mind is: how hard is it to film people dealing out cards? A fair question – it's really not that hard. But there's much more to it. Evolution is responsible for yes, the filming, but also making sure millions of concurrent users can play at the same time, building out the actual app, and aiding in the marketing. Plus, it's all about specialization. The 40 land-based casinos that are Evolution customers don't have the expertise to become a media company and invest in the technology to make the customer experience flawless. For all of this, Evolution charges between 10-15%. Some operators complain about this take-rate but they are paying a premium price for a premium product. No other competitor quite comes close to the quality of Evolution. And Evolution is constantly getting better. They now even have an entire machining workshop focused on building new set props like Crazy Coin’s coin flipper.

Another piece of evidence of the company’s moat is that it has one customer (in my opinion its holding company, Entain) that accounts for 14% of revenue. Ordinarily that is a large risk, and it is, but it’s also a testament to its value since this customer is paying $200 million. To not insource this functionality, especially if its just “live-streaming”, would be quite strange if you’re spending $200 million. There is clearly something more at play since this customer chooses not to save the money and do it themselves. Evolution is the full package and provides these online and land-based gambling companies incremental revenue through its great customer experience. Paying 10-15% of the winnings is a small fee, compared to having nothing at all.

The real reason some operators may get upset if is they look at Evolution's income statement. Last quarter, the company converted 64% of its revenue into EBIT. 64%! Further, EBITDA margins were more like 71%. 71%! It's clear that the company's services are priced at a premium. But the relationships are incredibly sticky.

If you enjoyed this, please turn that ♡ into a ♥️. This will help others find this newsletter. Thank you so much 😁

What Else We Offer

For self-directed investors: Dynasty Membership

Long-biased fund: Infuse Partners (intro call)

More content (The Investing City Podcast, online course, and blog)

If you’re interested in advertising, just fill out this form

wow crazy business model ...