Welcome to the new subscribers from last week! If you haven’t already, join 9,719 other business lovers and subscribe for free:

Today’s post is sponsored by Stratosphere.io. It’s a financial data platform that we use and it’s awesome for gathering and visualizing financial data for any company you’re researching.

Get started researching on the Stratosphere.io platform today, for free. And you can use the promo code: investingcity for 25% off your first year.

Lululemon, aka Lulu, is a luxury clothing brand in the athleisure market (read: comfy clothes). They are able to sell their clothing at a significantly higher price than their competition due to brand loyalty and product quality. Lululemon breaks its revenue into three segments:

Company-operated stores made up 45% of revenue

Direct-to-consumer (DTC) accounts for 46% (online sales)

Revenue from the acquisition of MIRROR made up the last 9%, though the company is now looking to sell this asset

Revenue by Segment

The company consistently has gross margins that near 60% — almost software-like. Compare to this to Nike at 46% or The GAP at 35% (acquired competitor, Athleta, in 2008).

Below you can see just how strong Lulu's gross margins and EBIT margins have been. This level of consistency is excellent evidence for the company’s brand loyalty.

As your wallet may know, Lulu charges a premium price which allows them to have larger margins. Before corporate expenses, company-operated stores segment makes 27% operating income margins while their DTC segment has 43% operating income margins. The higher margins are due to the capital-light model of direct to consumer model; the DTC segment is the real cash cow of the business.

Despite the higher margins in the DTC segment, Lulu has been expanding its store footprint as they believe it is important for their competitive advantage. Lulu has 655 total stores compared to last year's 574 and 521 in the year before that. Currently, the US makes up 56% of the store footprint but international store openings account for the majority of net new locations. Interestingly, the company opened 31 stores in China last year compared to 26 in the US.

Industry Trends

In 2021, Athleisure was an $87 billion market, expected to grow around 8%. This growth is largely due to the increasing acceptance of wearing athleisure clothing in more settings.

Source: Grand View Research

Lululemon has 9% (TTM revenue divided by industry size of $87 billion) market share in the athleisure industry, but most of this comes from the women’s segment. In terms of future growth, mens and international provide ample opportunity as they only account for 25% and 15% of sales respectively. Further, ex-North America sales are supposed to grow at 30%, higher than their core business.

You can see above that men’s revenues have doubled over the past two years, having grown slightly faster than overall revenues.

Competitive Advantage/Strategy

In 2019, Lululemon’s management team clearly outlined their strategy to investors and named it the “Power of Three” for the three pillars of their strategy. The goal was to double revenue through focusing on the pillars of product innovation, omni-guest experience, and market expansion. All three of these pillars support their competitive advantage which is their brand name. More recently, the company announced “Power of Three x2” a five-year plan, continuing its focus on the same pillars.

I’ll let Morningstar speak to the company’s product innovation:

Morningstar described the R&D that Lulu undergoes in their “science of feel”. The company maintains a whitespace research and development department of about 50 people that includes textile workers, scientists, and engineers. Although fabrics cannot be patented, its signature Luon fabric was developed two decades ago and was trademarked in 2005. It consists of a greater amount of nylon microfibers than a traditional polyester blend. Lululemon has produced several other performance fabrics, some of which are also trademarked (but not patented).

For their omnichannel guest experience, they have focused on making the online experience frictionless and improving search on their website. These actions are common among e-commerce brands, but their store actions are unique. They are expanding their store count and offering in-store yoga classes to build brand loyalty. These yoga classes are an efficient way to get customers into the store and foster a community.

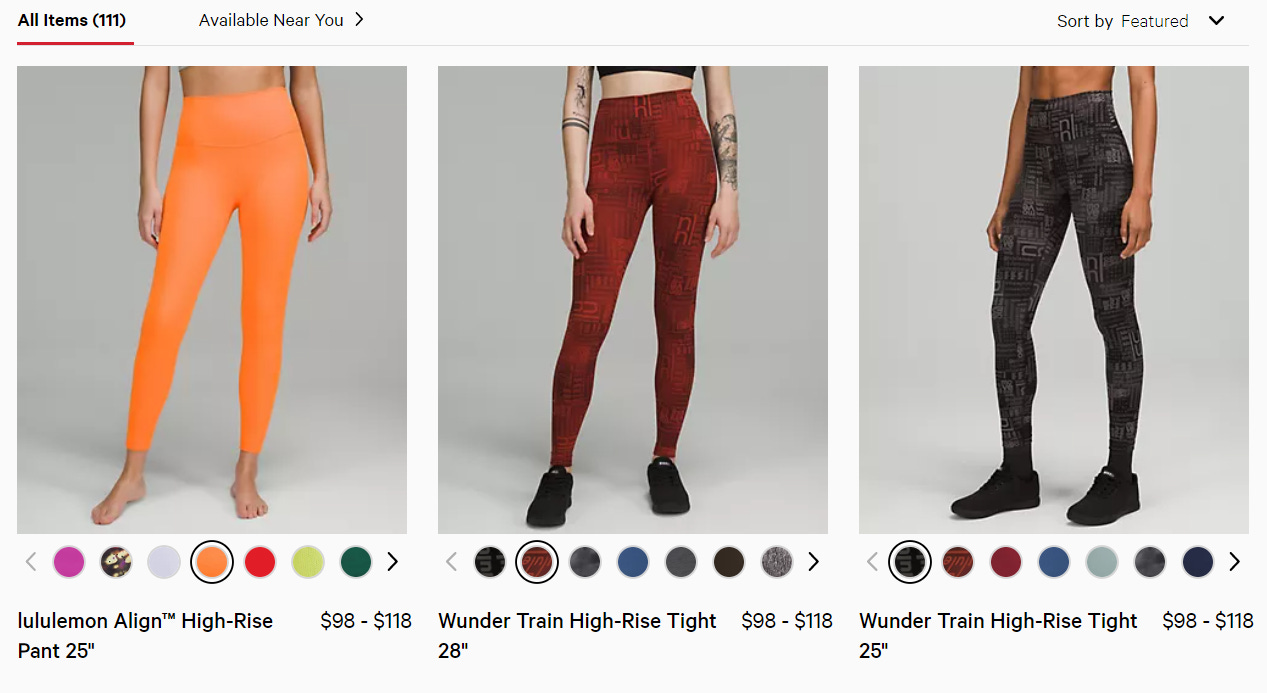

Lululemon's brand loyalty is evidenced in its prices. Lululemon's women's leggings often exceed $100 per pair. By comparison, the closest competitor Gap’s Athleta leggings are usually priced between $70-90. This advantage in brand loyalty is further emphasized by their sales per sq foot numbers.

According to Morningstar, “Lululemon's sales per square foot increased to $1,657 in 2019 (before the pandemic) from $1,541 in 2015. In 2017, wide-moat CoStar reported Lululemon had the highest sales per square foot of any publicly traded apparel retailer in North America. For comparison, no-moat Gap, which owns the competing Athleta chain, reported sales per square foot of $323 in 2019.”

Gap’s Athleta had just under $1.5 billion in sales last year or less than 25% of Lulu’s total sales. Gap has been heavily investing in Athleta stores as it seeks to benefit from Athleisure trends and capitalize on one of its better brands. While Lululemon has a better brand image and competes at a higher price point than Athleta, its heavy investment could still be a headwind for Lululemon.

Management/Capital Allocation

In July 2018, Calvin Mcdonald was promoted to CEO of Lululemon in wake of Laurent Potdevin's dismissal due to allegations of workplace misconduct. Shortly after the promotion, Mcdonald unveiled the “power of three” strategy which has been well received by shareholders.

Lululemon does not offer a dividend, but since Mcdonald’s appointment, they have returned most of their free cash flow back to shareholders in the form of share buybacks.

On the Q4 call, management stated, “For the full year, we repurchased 2.2 million shares, returning $813 million to shareholders. By mid-March, we have completed our current authorization, and I'm pleased that our Board has authorized a new $1 billion program. This program is our largest individual authorization ever and speaks to the optimistic view of our future shared by our management team and our Board of Directors.”

Mcdonald also made Lululemon’s first acquisition in 2020, when he bought MIRROR for $500 million.

“In 2019, Lululemon detailed its three-fold vision to be a brand that doesn’t just sell clothes like leggings and sports bras, but that encourages people to sweat more. ‘The acquisition of Mirror is an exciting opportunity to build upon that vision,’ McDonald said Monday. He added that the fitness company expects to do more than $100 million in revenue this year, and it will either break even or be slightly profitable in 2021.”

However, the company took at $442 million goodwill impairment on the MIRROR acquisition and is looking to sell the asset. In hindsight, it’s safe to say the acquisitions was a total mistake that cost the company about six months of normalized free cash flow. However, the growth rate of MIRROR in June of 2020 when stay-at-home fitness was all the rage, was astounding. And beyond the $39/month recurring revenue, the logic was also that customers could purchase more gear straight from the MIRROR in between their work-outs — yet another touch point for customers. The acquisition seemed to fit into the company’s strategy but it just didn’t pan out. This seems like just another piece of evidence that it’s very hard for a company to do something well outside its core competence if it’s not structurally created for experimentation. I would personally much rather a company experiment internally rather than go do a sizable acquisition. It’s very difficult to integrate companies, especially when its product or service is not the parent company’s core competency.

Risks

Lululemon’s main risk is the impairment of its brand image. Lululemon’s main competitive advantage is their brand loyalty and losing that would significantly impair their future growth, thus, their stock price. Lululemon has had two management scandals in the past including:

In 2005, ousted founder Chip Wilson stated it was too expensive to make plus sized women’s clothing. In 2013, he doubled down on the remarks.

In 2018, former CEO Laurent Potdevin was dismissed due to allegations of workplace misconduct.

While these incidents have not impaired Lululemon’s brand, it’s important to understand the context. Quite honestly, the fact that these scandals haven’t done anything to hurt the brand, my gut says that the brand is stronger than lots of Wall Street folks think.

Summary

Lululemon is a leader in the luxury athleisure industry. They have industry tailwinds benefiting them as the acceptance of athleisure grows. The company has a strong competitive advantage in their customer loyalty, but losing that is also their biggest risk.

If you enjoyed this, please turn that ♡ into a ♥️. This will help others find this newsletter. Thank you so much 😁

What Else We Offer

For self-directed investors: Dynasty Membership

Long-biased fund: Infuse Partners (intro call)

More content (The Investing City Podcast, online course, and blog)