If you haven’t heard, we just tore down the pay-wall on Business Breakdowns to make it a free newsletter. As part of the re-launch, we’re rolling out our formerly paid articles over the next several months so sign-up if you’d like to get hit with an avalanche of free business analysis!

This will be the last one for several days — we’ll give your inbox a break by sending the next one on Saturday 😂

McDonald's doesn't sell burgers, it sells franchises. In other words, it's a real estate company, not a fast-food restaurant.

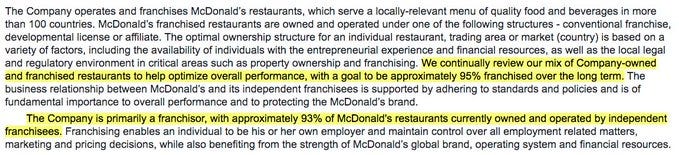

The company's goal is to have 95% of its restaurants franchised and it’s at 93% now.

There are four ways McDonald's does business.

Company-owned and operated

Conventional Franchise

Developmental License

Affiliate License

Company owned restaurants are pretty straight-forward, McDonald’s runs every piece of the establishment. A conventional franchise is when McDonald’s sells rights to another entrepreneur, the franchisee, and takes a royalty and rental fee in exchange for using the brand name and operational processes. In this case, McDonald’s will own the land and the building but the franchisee will pay for equipment, signs, seating, etc. A developmental license is when the franchisee will own and develop the land and thereby pay a smaller percentage of sales to McDonald’s, the franchisor. These are less common agreements (about 15% of franchise sales) and even rarer (~10%) are affiliate licenses that are used in a limited number of foreign markets where McDonald’s will only own an equity share of the establishment. The main two to focus on are the company-owned locations and conventional franchises.

The company has 40,013 restaurants, 37,295 of which are franchised. So that means 2,718 are company-owned and operated.

Let's look at the margins on franchised locations vs. company-owned.

Company-owned gross margins: 17%

Franchise gross margins: 81%

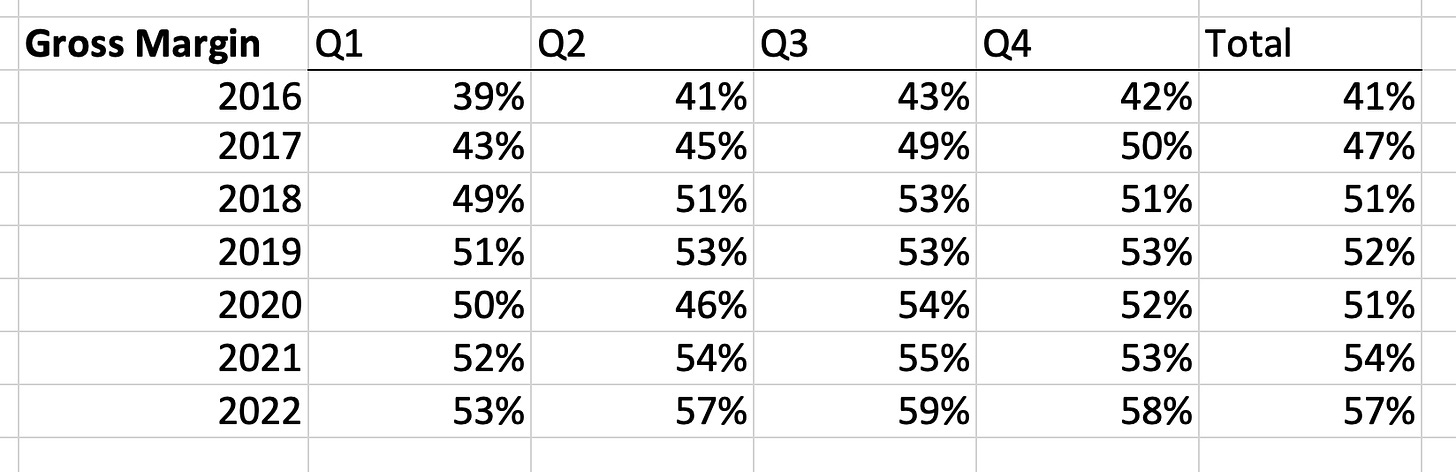

It's no wonder the company is aiming for a 95% franchise model. Just look at how blended gross margins have trended as the company has done more franchising:

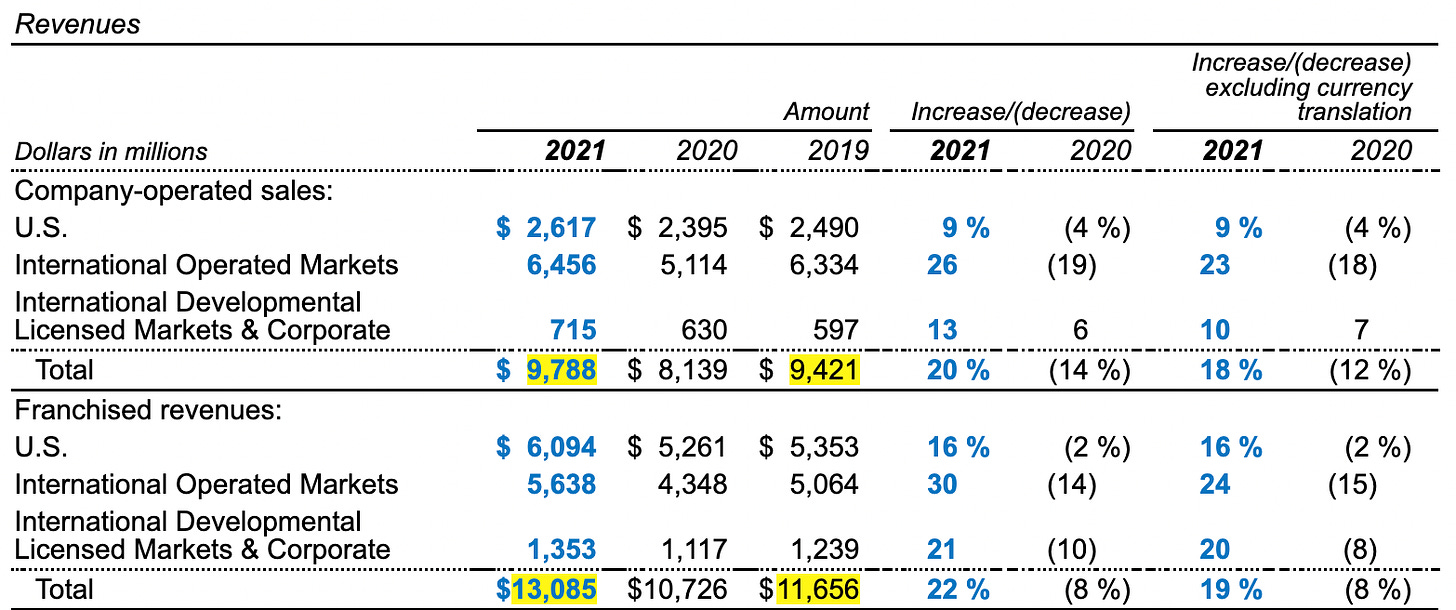

And here is sales breakdown for franchise vs. company-owned.

Franchise revenue as % of overall sales: 57%

Company-owned revenue as % of overall sales: 43%

In fact, since 2015, franchises as a percentage of overall sales have increased from 35% to 57%.

As a result, the company boasts some very strong overall EBIT margins.

Compare these ~40% EBIT margins with Chipotle, which owns and operates all of its restaurants.

So what gives? Why would Chipotle not do any franchising?

There are a bunch of reasons, like how it’s more difficult to have food quality oversight or entice employees with internal promotions, but mature restaurant concepts typically end up franchising because that sweet, sweet high-margin revenue is too good to pass up. Further, mature concepts also usually have more brand recognition and bargaining power with franchisees.

Here are the total revenue per store numbers for both restaurants.

McDonald's: $2.7 million

Chipotle: $2.8 million

Chipotle has 3,187 restaurants compared to 40,013 for McDonald's.

Further, the 37,295 franchised locations did nearly $103 billion in sales last year, and McDonald's made $11 billion from that.

You can think of McDonald’s business as having a take-rate, similar to how Amazon’s revenue is a percentage of total sales that flow through the system. McDonald’s franchisees did $102 billion in revenue but McDonald’s did $13 billion in revenue on that, like a 13% take-rate. Moreover, the gross margin (what the company calls restaurant operating margin) was 81% on that revenue.

To put the numbers another way, company-owned restaurants accounted for $9.8 billion of the company’s $23 billion in revenue (43%). However, they accounted for 9% of total sales that flowed through all restaurants. That’s because the “take-rate” for company-owned stores is 100%, there is no royalty. So despite company-owned stores making up 43% of revenue, they only accounted for 14% of restaurant margin. The sweet power of the franchise margin, while McDonald’s is about to own the underlying real estate.

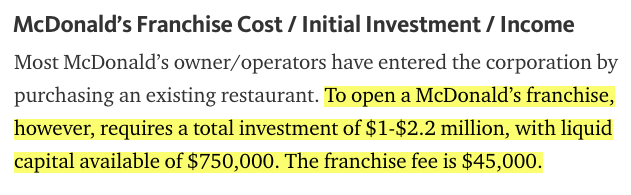

So here is McDonald's business model in a nutshell.

Take out debt to buy land

Find a franchisee from the waitlist

In exchange for the brand and operational know-how, franchisees pay royalties and start-up costs of roughly 13% of sales.

Enjoy 40%+ margins

Rinse and repeat

To hammer home the point on McDonald’s being a real estate company, the company has $36 billion in net property, planet and equipment (PPE), which is 156% of total sales. This means the company owns $36 billion in real estate, even after depreciation. Even Prologis, the biggest owner of industrial real estate in the US had just $9 billion more in net PPE ($45 billion) last year.

See, McDonald's IS a real estate company after all.

The real competency of McDonald's is real estate, not burgers.

Even with $45 billion in net debt on the balance sheet, the company's $5-7 billion of annual free cash flow is way more than enough to cover the $1.2 billion in interest expense.

We’ll end with a fun fact: McDonald's has 4.6% market share of the ENTIRE restaurant industry.