If you haven’t already, join 10,400+ other business lovers and subscribe for free:

I use Koyfin every day. From staying on top of company news to the most advanced screener you can find, it’s an incredibly good investing tool. My personal favorite is the customized financial templates. Using Koyfin’s shortcuts, I can pull up revenue, gross profit, EBIT, FCF, net debt, goodwill, ROIC, and working capital dynamics for any company in seconds.

I also have a huge watchlist that helps me with earnings dates and allows me to easily find new transcripts and filings. Rather than having one charting software, one for filings, one for transcripts, and one for financials, Koyfin has it all. And the best part is you can customize it exactly to your preferences. I rarely am passionate about investing products but this is one I strongly believe in. Because you’re a Business Breakdowns reader, use the button below to get 10% off on a plan today!

Background

Paycom was founded in 1998 by Chad Richison in Oklahoma City. Originally from Oklahoma, Richison attended Central Oklahoma University. Upon graduating, he took a job at payroll giant, ADP, and worked there for a few years. After a short stint at another payroll company in Denver, Richison moved back to Oklahoma with his sights set on starting a payroll provider. He saw the value of the internet for record keeping so he got an SBA loan, maxed out a bunch of credit cards, and started building a website for his payroll business, Paycom. Starting an internet business in Oklahoma meant that Richison didn’t have the most technologically savvy customers. He retells stories of doing in-person sales consultations where he would install and teach a customer how to use the internet. However, moments like these never discouraged him. The internet was growing extremely fast and the sleepy payroll incumbents weren’t even paying attention to it. That was his differentiation.

Biz Overview (Product/Value Prop/Rev Model/Distribution)

While you wouldn’t necessarily think that a software business from Oklahoma would be cutting edge, Paycom has continually been ahead of the competition. The company now has over 36,000 clients and one of its main value-adds is self-management of payroll. Traditionally, an HR employee would manage the payroll but Paycom’s BETI (Better Employee Transaction Interface) allows employees to manage their own time-sheets and payroll processing. Obviously an employee doesn’t set their own salary (haha) but they can manage sick days, clock in and out, update their retirement settings, and even get paid on a debit card immediately.

Recently, Richison had this to say about BETI:

“We have made many innovations in those 25 years, but none more important than do-it-yourself payroll for employees with Beti. This is a paradigm shift for our industry and delivers tremendous value to our clients when employees do their own payroll.”

Over 65% of clients have made the switch to BETI but that is actually a headwind to the top-line numbers at the moment. In the past, if an HR employee made a mistake and had to re-run payroll, there would be an extra charge for that. However, since BETI can be accessed by employees anywhere at any time, the software also prompts employees if there seems to be a mistake. This is a biased study commission by Paycom but apparently this has decreased payroll-related errors by up to 80%. It turns out that employees care about when and how they get paid! Who would’ve thought? It’s actually a win-win scenario. HR reps can focus on hiring and employees can have more control over their pay schedules. But it is somewhat affecting Paycom’s revenue growth since one-off error-related charges are down significantly. That’s tough in the short term but I’m sure customers are happy which is great in the long term.

Going back to hiring, Paycom has also expanded its product offering into a more comprehensive human capital management (HCM) system. While still primarily focused on payroll, the company also has an applicant tracking software, onboarding programs, an employee performance tool, among various HCM products.

One very interesting part of Paycom’s business is its sales centers. It has 55 sales teams in physical locations across 28 states. One team typically consists of a leader and 8 reps (Paycom calls them CRRs or customer relations representatives) that call and meet with clients every day. This is the primary way that leads are serviced. Since it takes a bit of hand-holding to get the payroll systems humming, these sales reps are very involved in the process. The sales cycle is roughly 1-3 months but the mission critical nature of payroll means that sometimes customers will run an experiment before making a full switch. They might just use Paycom for hourly workers and then shift everything over if it works well.

The Numbers

Since the 2014 IPO, the company has spent $1 billion on capex. That means the company has spent 11 cents for every dollar of revenue it has brought in over the past decade. That’s a reasonably high capital intensity for a software business. In 2023 alone, Paycom spent nearly $200 million on capex. But if you dig deeper, about 1/3rd of that is capitalized software for internal development. And if you dig just a little deeper, you’ll find that the company actually operates three of its own data centers, which is very costly. From early on, Richison did not trust the public cloud providers to maintain 100% uptime since payroll is so mission critical. He believed it just couldn’t be as secure and stable as their own systems. And he hasn’t changed his mind, despite nearly every other software company doing so. There are pros and cons to this but I imagine the pace of innovation probably isn’t as fast as smaller, cloud-native companies like Gusto or Rippling.

However, Paycom’s aggressive sales tactics and employee-managed ethos has propelled the company quite far. Revenue has grown from $150 million in 2014 to $1.7 billion last year, a staggering 30% CAGR over almost a decade. EBIT margins have been the low 30%/high 20% range and FCF margins come in just under 20% because of the capital intensity we discussed. But most of that is likely due to the company operating its own data centers. Under a cloud-based model, a lot of the capex that Paycom is forced to recognize would be labeled as an operating expense. So it’s probably better to value this company on FCF rather than EBIT.

Market Size/Competition

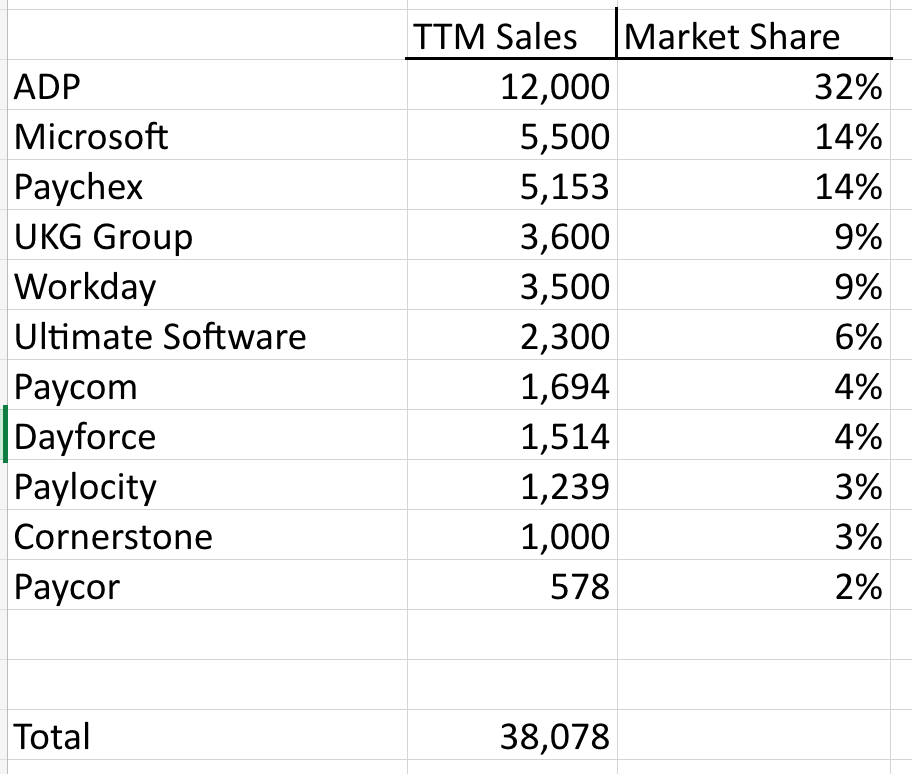

The payroll industry is huge. The giant in the space, ADP, does $18 billion in revenue but about $6 billion of that is from its professional employer organization business. Then there is Paychex with another $5 billion and many other players. Below is an estimated market share chart with Paycom still less than 5% penetrated.

I tried to only include HCM revenues for the companies above but even despite the adjustments, the TAM is still large. Competition often accompanies a large TAM and payroll can be downright brutal, but the industry is notorious for having incredibly high retention rates. Paycom has a 90% gross revenue retention rate and it has a good chunk of SMB customers that often aren’t hiring or may go out of business.

Moat

The payroll industry is famous for low churn. Switching providers and risking an error or not running payroll on time – means that customers are very hesitant to switch, even for a better price. That’s why so many payroll companies have been great performers and are quite profitable. Further, there is strong pricing power and these companies can add on other modules like hiring, performance management, and outsourcing.

Since the industry is so large and the incumbents’ software is not user friendly, Paycom has been able to gain market share. However, there are newer competitors like Rippling and Gusto that are cloud-native and based in the Bay Area, with access to excellent talent. In fact, Rippling’s last funding round pegged its valuation over $11 billion – already higher than Paycom.

As you’ll hear in the next section, when you have the CEO saying that the product is not good and there are faster-moving competitors, it’s not a great combination. Fortunately, the industry has fantastic economics and Paycom has a strong track record of sales velocity. I don’t necessarily see a deep moat besides the fact that it has a large installed base and the switching costs are extremely high.

Risks

The main risk I see with Paycom is actually cultural within the company. If you talk to employees, there is a very high level of burnout and a general lack of satisfaction. Mr. Richison is a hard driving leader who hires folks fresh out of college and works them long hours. Interestingly enough, there is a secretly-recorded audio version of a meeting with Richison. It’s about 20 minutes long but it includes Richison saying that the product is messed up and he needs to cancel all of his ski trips to get the product back on track. He doesn’t quite strike me as an aspirational leader but it’s hard to judge based on a short meeting, where we don’t have all of the context. There is a point where he mentions that if they had stayed with their old software development model for five more years, it would’ve killed them. I don’t know if he’s exaggerating but in an industry with a lot of competition, the quality of people is one of, if not the most important variable for success. And the fact that Paycom doesn’t seem to satisfy employees is a little worrying.

I don’t want to extrapolate too much from that short meeting, but Richison also says that this job is just about a paycheck for him – he didn’t seem passionate about it at all. I found that quite surprising considering he has spent his life grinding on this company.

Management

Chad Richison is integral to the company. After all of this time, he still owns 14% of the company, or a $1.6 billion stake.

And he also has a generous long-term incentive package with stock price targets. Granted in November 2020, he has 6 years to help the stock price reach $1,000/share (up from current $190) and then ~800k options will vest, worth at least $800 million. The second part of the package is another 800k in 2030 at a stock price of $1,750, or at least $1.4 billion. So if, over the next ~7 years, the stock is a 10-bagger (39% CAGR), then Richison will get 1.6 million options and if he doesn’t sell any stock, it will be worth at least $2.8 billion. In total, at $1,750/share, the market cap will be $106 billion, or $95 billion in value created. So Richison would be capturing about 3% of this created value.

Personally, I really like these sort of incentive packages as it incentivizes long-term thinking. For Paycom to support a $100 billion valuation, it probably needs to do at least $3 billion in FCF, which means at least ~$10 billion in revenue. That means revenue would have to CAGR around 28% from here, which seems very unlikely considering the ‘24 guide is for 12% growth. There is a possibility that BETI will accelerate the top-line as customers realize the value of it, but that seems pretty steep. Even if we use more aggressive assumptions, sales still need to CAGR more than 20%. So frankly, I would be very surprised if Richison is able to reach these goals. The 2026 cut-off is less than 3 years away and that would be more than a 400% increase. I just don’t see Paycom’s stock price CAGR’ing at 71% but that’s just me lol 🙂

Further, the Paycom culture tends to be very intense and sales driven. It’s certainly not the cushy Silicon Valley ethos. Paycom hires fresh college graduates for its sales rep and works them very hard. The company doesn’t primarily focus on pedigree – there are many stories of Paycom hiring folks without degrees and them succeeding.

Conclusion

Paycom has a long record of success, taking share in a competitive, but technologically-challenged, industry. However, with incremental competition and a lacking company culture, the future looks much more uncertain. The company is making a bold bet on BETI, which could pay off handsomely if they get it right. I do admire the long-term thinking from the founder, but the company is also very dependent on Richison. Luckily the industry is large and has high switching costs, or else I’d be more worried about Paycom. On one hand, at 15x EBIT, the valuation reflects some of these worries but when you take into account the large software development capitalizations, Paycom still trades for more than 25x FCF. If they can re-accelerate growth, the stock should do fine but it’s not necessarily a no-brainer even despite the lackluster stock performance of the past year. If, however, revenue can accelerate into 2025 because of BETI, then it seems like a pretty good set-up.

If you enjoyed this, please turn that ♡ into a ♥️. This will help others find this newsletter. Thank you so much 😁

How Can We Help?

Looking to become a partner in our long-only strategy?

Interested in advertising to more than 10,000 investors?

You say, "And he also has a generous long-term incentive package with stock price targets...Personally, I really like these sort of incentive packages as it incentivizes long-term thinking."

Unfortunately, it is the other way around. Incentives should never be linked to share price. Share price can be manipulated upwards while the fundamentals of the business decline. Slash R&D, advertising and other OPEX costs and short term earnings jump higher. If the multiple remains the same, the share price jumps up, but what do you think happens to the long term prospects of the business?

Management can asset strip the company, selling core assets to improve short term cash flows. It won't help the business in the long term.

Overpriced share repurchases destroy balance sheet equity, but they create artificial demand for the shares pushing them up temporarily. Momentum investors then jump on the bandwagon causing the share price to jump higher. The bubble keeps inflating until it goes pop. Meanwhile, so much capital has been pumped into repurchases, that reinvestment in the actual business itself gets neglected. That's not good for the long term either.

All of these things happened under the tenure of Lous Gerstener when at IBM from 1993 - 2002. All because the incentives were wrong. The same thing happened under Sir Terry Leahy at Tesco during his tenure that ended around 2011. There are loads of case studies for this kind of thing. Check them out.

For me this is a huge red flag! Not only is the remuneration committee incompetent, but the CEO has acquiesced in this nonsense which doesn't tell me anything good about him either.