Today’s sponsor is Fintool. Fintool is an AI copilot tailored for institutional investors. Frankly, it’s amazing at comparing earnings transcripts and finding key quotes. One of my favorite things is that it links to the source documents and highlights the specific quote so you can verify everything. It has saved me and institutional investors like Kennedy Capital or First Manhattan a lot of time. It also has a qualitative screener that is quite interesting.

I remember getting on the Robinhood waitlist in 2014, shortly after the product came out. I was actually doing an alumni interview as part of applying to Cornell (I ultimately got rejected) and the woman asked if I had heard of Robinhood because we got talking about stocks. I hadn’t. So I immediately downloaded it and we were talking about how the company made money on free trades. We Googled it and it turned out they made money on uninvested cash balances. That made sense to me and I proceeded to type in every single variation of my email address with periods in between since, if you got other people to sign up, you could move up the waitlist. Robinhood had a near perfect product launch. They were able to create buzz by utilizing a waitlist and this strategy of moving up via inviting your friends [that is, or circumventing the system by typing in ryanp.aulreeves13@gmail.com and ryanpa.ulreeves13@gmail.com and every combination in between].

This experience is still very fresh in my mind, even though I was in high school. That’s how well designed Robinhood was and is. It made stock trading fun and so accessible. Free trades, sign me up! Unparalleled user interface, yes please! Just swipe up and boom, you’re able to buy a share of Amazon. But even back then, the company wasn’t completely forthcoming about how they made money. And this is my tension with Robinhood. It’s clearly an incredible company with an unbeatable product experience but I also sense a lack of integrity at certain times. Note, that this is subjective so I don’t necessarily want to sway you, but just lay out my perspective, which could change at any moment.

Even back then, when I first Googled how Robinhood made money, they were elusive with the real answer. In beautiful irony, when I just Googled this same question, the Google AI comes up with the real answer, but when I scroll down to find a Robinhood FAQ link, this is what pops up:

If you note the URL link, not much has changed in the past 10 years. Robinhood doesn’t want their customers to know how they actually make money. As a smart person once said, if the product is free, then you are the product. And that is quite true in the case of Robinhood.

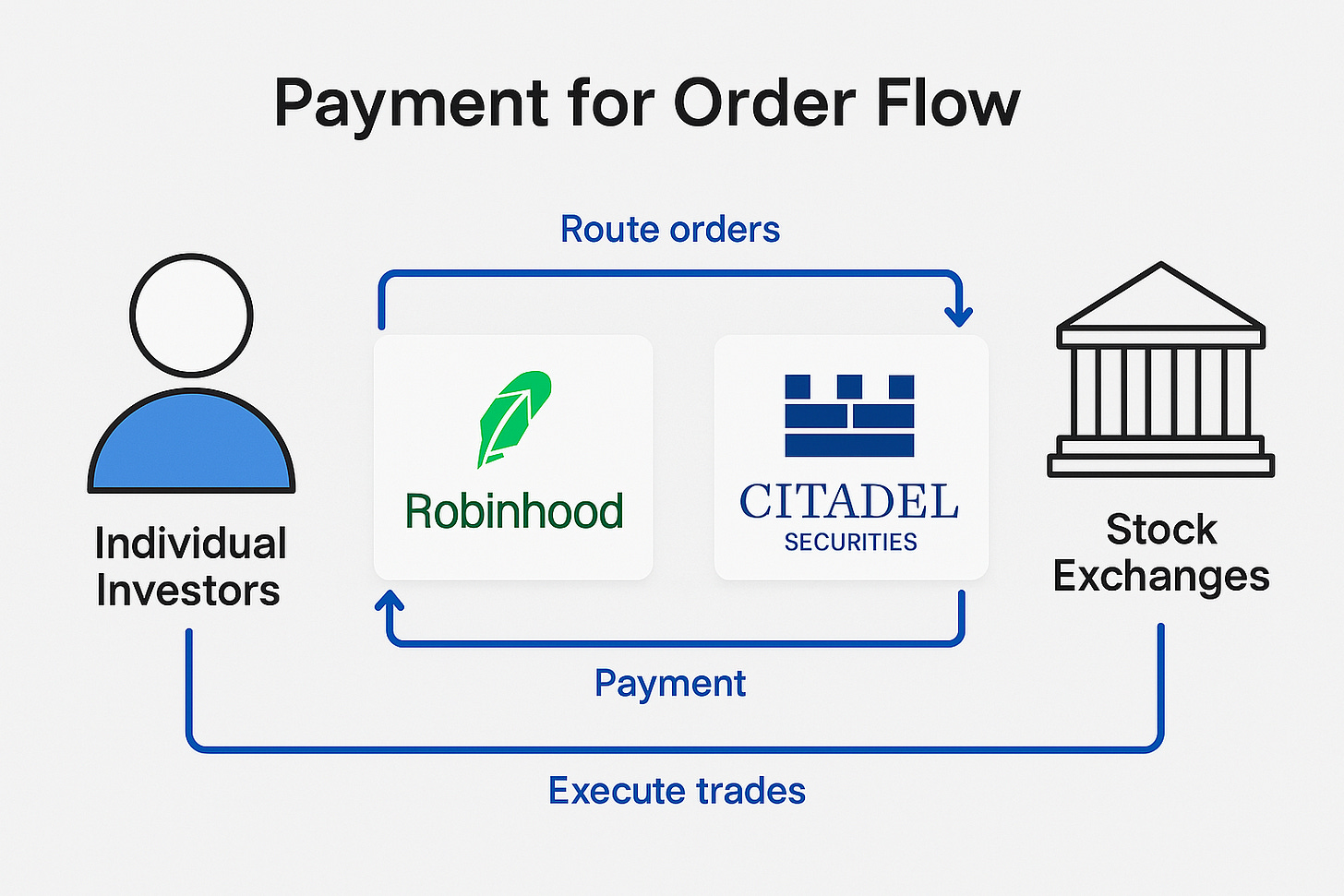

Basically, Robinhood makes money by taking a percentage of the spread between the bid and ask in a stock. This is called payment for order flow (PFOF). Robinhood is a top of funnel aggregator for market makers. It’s a beautifully designed liquidity pool for Ken Griffin (founder of Citadel). That is the less charitable view. The more charitable interpretation is that the execution is a penny worse for millions of $100 trades for retail investors and the fact that people are getting involved and learning about markets is a long-term net positive. See – it’s somewhat subjective. The gamification and casino-fication (definitely not a word) of investing is short term very negative but maybe positive as it enables true learning and losing money is the best real-world experience. That is, it can also lead to disillusionment regarding the stock market and maybe even capitalism in general. But we’re veering too far into philosophy – let’s get back on track.

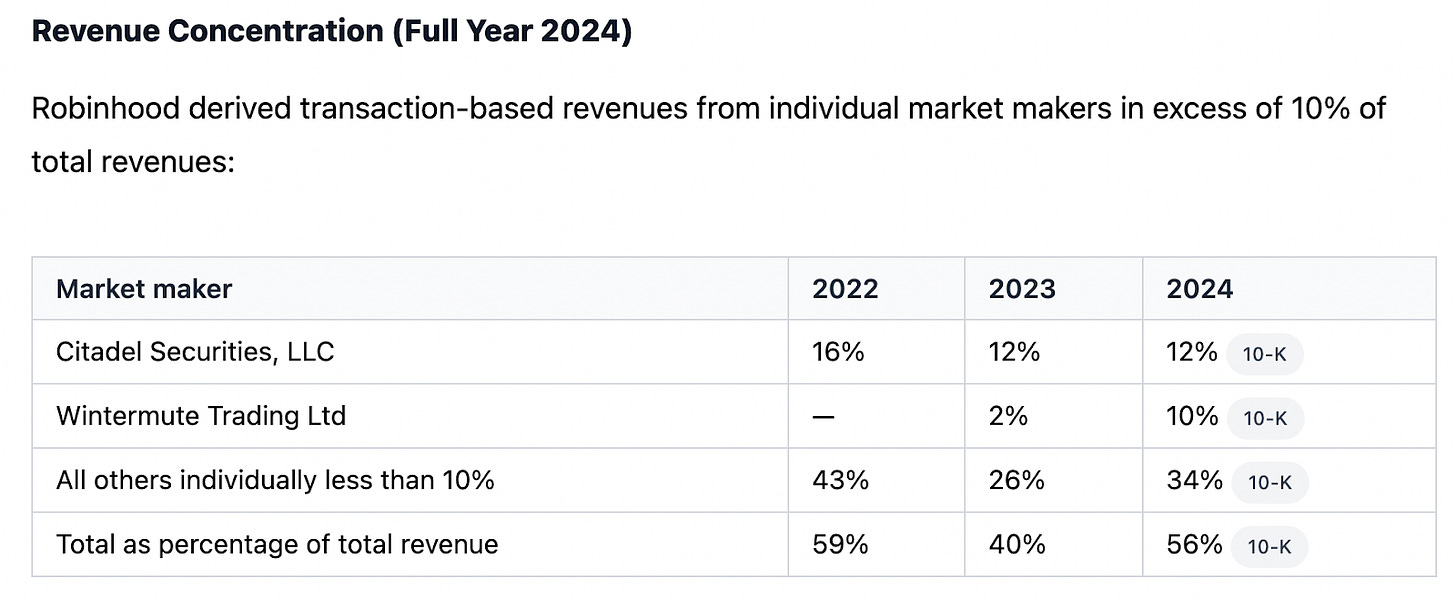

Below you can see the concentration of the market makers that are on the other side of trades made on Robinhood. The company has decreased its reliance on Citadel a little bit and Wintermute is the clearinghouse for Robinhood crypto. Market makers are a crucial part of the finance world. The main service they provide is liquidity. Without them, bid-ask spreads would be much higher. They narrow these spreads and make money by taking pennies as a cut.

You can also see below the exact amount that the market makers give to Robinhood. Because, since Robinhood enables “free” trades, their customers are actually these market makers. For example, for a market order, Citadel offers about half a penny (.47 cents) per share on S&P 500 stocks. Interestingly, the calculation is per share, not on the total value. So it's in Robinhood’s best interest then to get people trading as much as possible. Note that Virtu is the partner that Robinhood uses for the 24/5 night-time trades so that is why the limit orders for Virtu are significantly higher than some of the other market makers since spreads are wider. Market making is very competitive but Virtu is the sole partner here so they don’t have to fight to get orders. That’s why Robinhood is able to command higher pricing here.

I don’t want to necessarily make it seem like payment for order flow is always slimy. There are SEC regulations that protect retail investors by ensuring better pricing than national best bid (NBB) or national best offer (NBO). These are the best prices across all exchanges at any given point. So let’s say the national best bid on a share of Apple is $191.1. Citadel, or another market maker, would give a price improvement of say 4 cents and then pay Robinhood their share for routing the order and keep the rest, less hedging costs. To break it down fully, Robinhood receives 12.35% of the spread between the NBO and NBB during market hours. So you can also see in the above chart which market makers are the most profitable. For instance, Jane Street and Citadel have the highest spreads in limit orders. To get granular, for a Jane Street non-marketable limit order, the average spread for share is about 6.2 cents per share (.77/.1235). So that’s the spread, then Jane Street will pay out .77 cents to Robinhood and keep whatever is left over after hedging costs. That’s how payment for order flow works! Complicated, right? Well, that’s why I think Robinhood has tried to downplay its business model a bit. But the thing is, it’s all about messaging. Hiding the truth makes things seem suspect. On the other hand, if Robinhood was more straightforward about the transaction business model, they could message it as helping the little guy by getting better pricing than NBO or NBB. Because that’s mostly true! The market makers exist to increase liquidity but it’s also in their best interests to keep spreads wider as they make more money. Still, there are regulations in place to try and prevent retail customers from getting taken advantage of. Now that we understand how Robinhood makes money on its trading platform, let’s talk more about the business in general.

The interesting thing about Robinhood is its level of ambition. It isn’t satisfied with just being a discount brokerage. That was just a fun way to get people in the door. It wants to be a financial powerhouse and truly democratize finance for all. The company is working on AI equity research assistants, a private banking experience where you can order physical cash like you would a burger on DoorDash, personalized portfolio management, betting markets, and even real estate one day. The optionality is significant. What I admire about the company is they do a good job focusing until they can expand their services. For years, they didn’t even have a Desktop experience because they were laser focused on the mobile brokerage model. Now, they offer IRAs, a full crypto wallet, a credit card, and a low cost subscription called Robinhood Gold which gives you perks like 4.5% APY on univested balances, instant deposit, and better margin pricing. Robinhood Gold is a great idea as it's only $50/year but it provides recurring revenue for the company. Right now, about 10% of users have converted to Gold, which is nearly 3 million subscribers. This provides a $130+ million recurring revenue stream that is growing over 80%. At 50 million users and 20% conversion that stream would be worth ~$500 million in revenue, which would convert to cash flow at very high rates. The current TTM EBIT is about $1 billion so Robinhood Gold could have a large profit impact.

Further, the company’s incentive offers are ridiculously good and they still have managed to be profitable. For instance, if you transfer an IRA, you get a 3% unlimited cash match. And last month, you could get 2% of the transfer value in normal brokerage accounts. That meant Robinhood would give you $20,000 if you moved $1,000,000 over. That is an insane bonus. But it works! All a customer has to do is stay with Robinhood Gold for 5 years. But that only costs $250. So how do they make the economics work in a situation like that? Well, that would be a large customer for the company. As of the latest data, Robinhood had $193 billion in assets under custody and 25.2 million funded accounts. So the average Robinhood customer only has less than $7,700 in their account. If you transferred that amount over, it would cost the company $154 in bonuses. So the payback would be 3 years on the Gold subscription but that doesn’t include trading volumes and uninvested float. The company definitely loses money on these bonuses but they view it as marketing. Brokerage assets are typically sticky and they just need to get customers in the door and they figure that they will make it up on trading volumes. The average revenue per funded customer is roughly $120. So between 25 million funded accounts, Robinhood does more than $3 billion in revenue. About 60% of that is from transaction revenue and the other 40% consists of interest revenue and Robinhood Gold subscriptions. The 40% interest revenue is from uninvested cash balances, margin financing for trading, credit card balances, and securities lending for short selling. These are not recurring revenues as most of them still depend on trading volumes. For instance, when things are going poorly and trading volumes dry up, margin financing will likely also be down. But this 40% isn’t as volatile as transaction revenue.

The big key for Robinhood will be to increase its assets under custody per customer. With 25 million customers and only $7,700 per account, there is a long runway to increase both of those numbers. For instance, the average account balance for a Schwab customer is roughly $275,000. With that framing, Robinhood still has a 35x growth opportunity. It will take a while but there is plenty of growth in the tank left for the company, especially considering they are very early in their banking offerings. Not that my advice is worth anything but I’d encourage management to be more transparent – customers aren’t stupid. If you explain things simply, they will support you even more fervently. I think the future is bright for the company if they can continue to garner trust from customers.

If you enjoyed this, please turn that ♡ into a ♥️. This will help others find this newsletter. Thank you so much 😁