If you haven’t already, join 9,855 other business lovers and subscribe for free:

I use Koyfin every day. From staying on top of company news to the most advanced screener you can find, it’s an incredibly good investing tool. My personal favorite is the customized financial templates. Using Koyfin’s shortcuts, I can pull up revenue, gross profit, EBIT, FCF, net debt, goodwill, ROIC, and working capital dynamics for any company in seconds.

Just like this for today’s company:

I also have a huge watchlist that helps me with earnings dates and allows me to easily find new transcripts and filings. Rather than having one charting software, one for filings, one for transcripts, and one for financials, Koyfin has it all. And the best part is you can customize it exactly to your preferences. I rarely am passionate about investing products but this is one I strongly believe in. Because you’re a Business Breakdowns reader, use the button below to get 10% off on a plan today!

CEO and founder, Tobi Lutke, originally created Shopify because he couldn’t find an e-commerce software that would enable him to sell snowboards. The Canadian coder would go on to not only sell snowboards but millions of merchants have joined him in creating online stores through Shopify.

Shopify makes money in a variety of ways but has two revenue segments:

Subscriptions

Within this, there are three SMB (small-medium sized business) tiers:

Basic

Shopify

Advanced

And then a fourth enterprise tier called Shopify Plus, which includes customers such as Heinz, Red Bull, and the Lakers. The pricing here is pretty straight-forward: 0.25% of revenue with a cap of $40,000 per month.

While Shopify doesn’t break out how many of its customers are in each tier, it’s safe to assume that most are still relatively small.

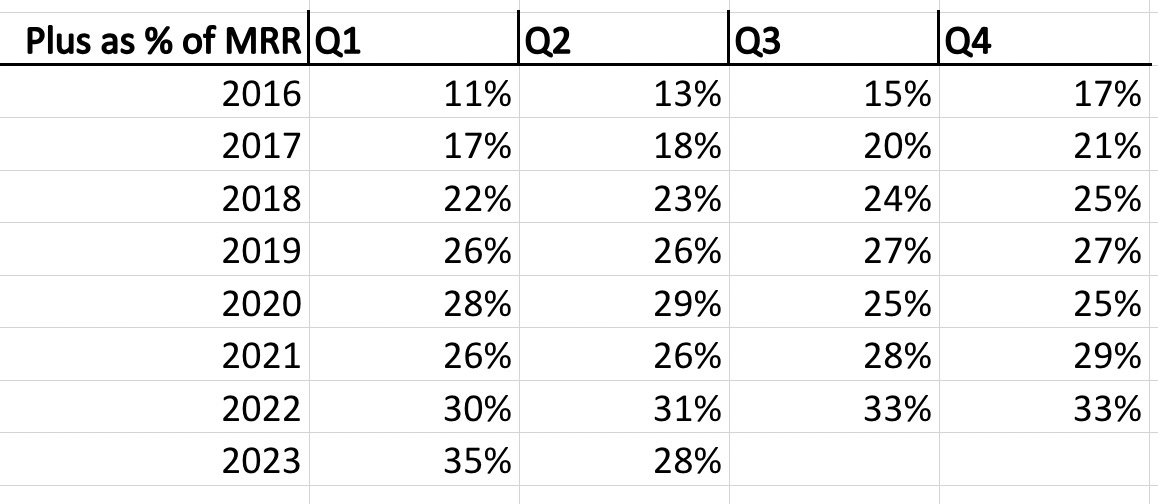

For one, Shopify Plus has stagnated to around 30% of the company’s monthly recurring revenue (MRR).

Second, if you take the ending MRR of each year and divide it by the number of merchants, we can get a rough idea of the average monthly subscription price.

2019: $54 million in MRR / 1 million merchants = ~$54/month

2022: $110 million in MRR / 2 million merchants = ~$55/month

That goes to show that a lot of merchants are still pretty small.

These monthly subscription fees allow merchants to build an online store, customize it, register a domain name, and start selling.

Merchants Solutions

Once merchants set up shop, Shopify also provides services to make life easier. These solutions include payment processing, shipping, loans, and point-of-sale systems.

Though the company offers all of these add-ons, Shopify Payments account for the majority of this revenue segment. To illustrate how big of an impact Shopify Payments has had, let’s look at a few charts.

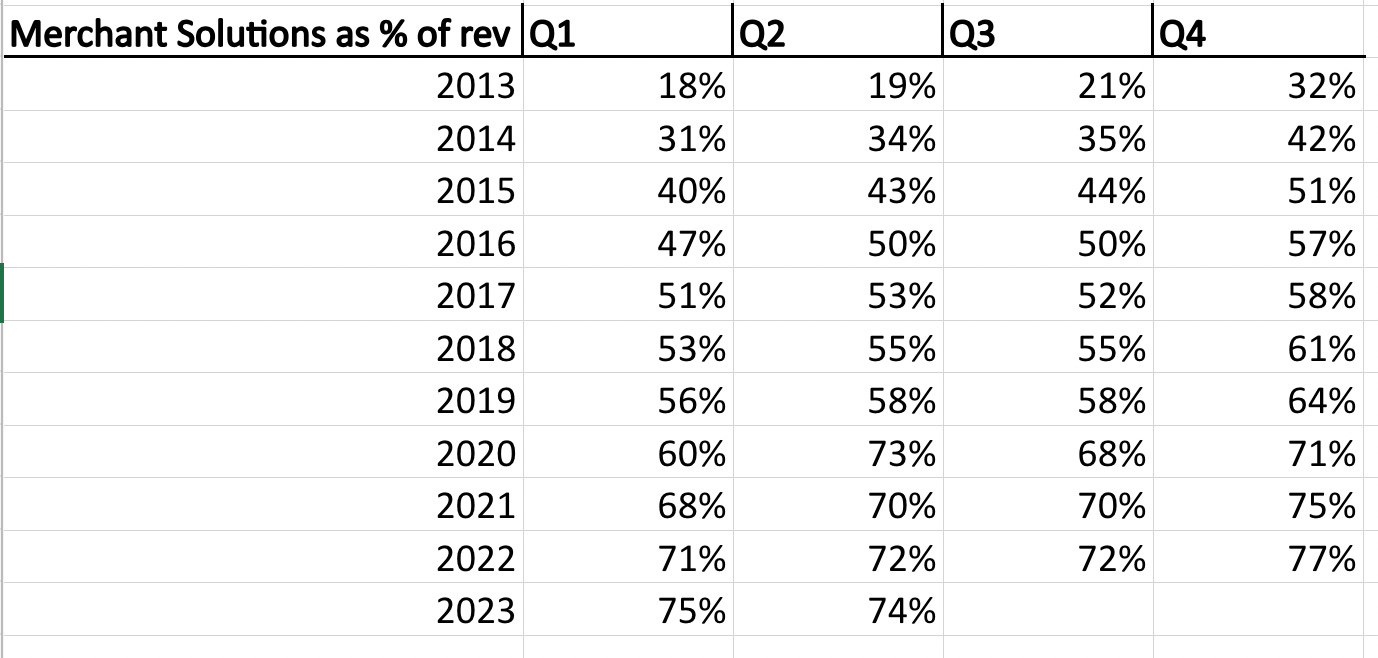

First, just look at the percent of overall revenue “Merchant Solutions” now accounts for:

Second, look at the company’s overall gross margins. Guess which quarter Shopify Payments was released (*cough* Q3 2013 *cough*)…

We can see that gross margins took a sizable dip in Q3 of 2013 from 81% to 75% and kept descending as the popularity of Shopify Payments grew.

This is because the gross margins for payment processing are much lower than for offering subscriptions. Just take a look at the difference in gross margins between the two revenue segments:

Further, here is how the company charges for Shopify Payments:

So the Basic Plan starts at 2.9% and then tapers off as Shopify Plus (not pictured) begins at 2.1%.

To incentivize merchants to use Shopify Payments, the company layers on an additional fee for using other payment providers (2.0% for Basic).

So far, 58% of gross merchandise volume (GMV) is processed through Shopify Payments. The likely reasons this number isn’t higher is because:

the service isn’t yet offered in all countries

some big merchants probably have a lower negotiated rate with their acquirer

Inertia

However, I suspect that gross payment volume (GPV) continues to increase as a proportion of GMV, adding more “Merchant Solutions” revenue.

To recap, there are two revenue segments:

Subscriptions

Subscriptions have four tiers and are made up of a lot of smaller merchants currently, but bigger accounts (Shopify Plus) are taking more revenue share.

Merchant Solutions

This segment is made up primarily of payments which have low gross margins but are adding a lot of total gross profit dollars.

What’s Next

For this next section, I will include my original writings on Shopify from April 2020 and then I’ll end with my current thoughts. My take on Amazon probably underrated its logistics advantage; although it was hard to predict that the company would double its distribution footprint over the next several months after April 2020. I think I did get the fact that Shopify’s valuation was a little crazy. The market cap is still below where it was 3 and a half years later.

Original thoughts from April 2020: Moving on, in my opinion, the most interesting thing about Shopify is its relation to Amazon. For so long, Amazon was nearly unrivaled in e-commerce and that has allowed it to get somewhat complacent. Amazon is getting bolder with pushing its private-label products as well as brands that advertise more to get pushed up in the search results. That’s not necessarily “customer-obsessed” as much as it is revenue optimizing.

This dynamic has created a perfect storm for Shopify to enable merchants to create their own stores rather than just selling on Amazon’s crowded marketplace. Sure, you’ll have to build your own demand generation, but Shopify also takes a much lower rate of your revenue.]

Let’s run the numbers.

In 2018, Shopify’s merchants sold a total of $41.2 billion worth of goods (GMV) and the company made nearly $1.1 billion in revenue.

On the other hand, Amazon’s third-party e-commerce business did roughly $160 billion in GMV and did $41 billion in revenue.

That means that Amazon took about a 26% cut of their merchant’s revenue whereas Shopify took only about 3%.

The question becomes: are the extra 2300 bps of take-rate worth it for demand generation?

What I mean by demand generation is that you can be found on Amazon’s marketplace when someone searches. There is no central Shopify platform where merchants can be found.

With this in mind, I think there are two implications/opportunities for Shopify:

Shopify can backward integrate into demand generation.

Imagine if Shopify bundled together a bunch of merchant stores through a slightly higher take-rate in the form of a subscription increase. The user interface of this bundle could be like Amazon where consumers just search for products.

This would also allow merchants more control over their brand even with a lower overall take-rate than on Amazon. As a caveat, I think this goes against the ethos of Shopify as making the experience all about the merchant. You wouldn’t know Tesla is using Shopify if you were navigating its website.

Shopify has room to inch up its take-rate

Whether it be through logistics or other add-on services, Shopify has room to grow sales through its take-rate. This means it has pricing power; however, as we’ve said before, pricing power is great, but using it can be dangerous. It’s a delicate dance but the fact remains that Shopify merchants seem to have solid consumer surplus.

To this point, Shopify has focused more on the on-boarding side of the business, rather than increasing the revenue per merchant. Just look at how many merchants have signed up in the past seven years:

This growth has accounted for most of the revenue growth and, in the future, growth will be sustained by expanding the revenue per merchant. This doesn’t have to be through brute-force increases, and it probably shouldn’t, but the company has room to add on more services. This will lead to higher and higher switching costs as well, deepening the company’s moat. One great example of this is Shopify’s recent acquisition of 6 Rivers which is an automated warehousing company. This came shortly after the announcement that Shopify launched its own fulfillment network.

Yesterday (4/20/20), the company’s market cap reached $75 billion. Yes, that is not a joke. On $1.6 billion in trailing 12-month sales. That’s a whopping 46x sales for a company that just hit free cash flow breakeven. It’s clear the company has great economics but it is re-investing absolutely everything and more back into the business. Interestingly, Shopify does about half of its business outside the US. The total addressable market is giant. Retail is about $5 trillion and the internet is really accelerating entrepreneurship. Clearly the market is valuing Shopify based more on its addressable market than its current fundamentals. COVID-19 is only accelerating this phenomenon. If you’re a big enterprise, you need a robust e-commerce business right now…period. At its current $75 billion valuation, even if the company could convert 100% of its revenue into cold-hard cash (obviously not feasible), it would be very expensive. But that’s what makes the markets so interesting. There are always two sides.

That was the end of the original section.

Here are my thoughts from today: Shopify now does $6.3 billion in TTM revenue, up from $1.6 billion but the market cap of $69 billion is still below where it traded in April 2020. In fact, at its peak, the company traded for over a $200 billion market cap on just over $4 billion in revenue. Good ole’ revenue growth extrapolation (which I was plenty guilty of during that period).

The real narrative during that time was that Shopify was going to overtake Amazon and build out this amazing logistics network but they didn’t actually have to be that capital intensive because (*hand-wave*) better software. So when they bought 6 Rivers in September 2019 for $450 million and then Deliverr for $2.1 billion in May 2022, and announced they’d be spending $1 billion on logistics over the next five years, the strategy seemed plausible. On the other hand, if you simply looked at Amazon’s cash flow statement, $200 million annually on logistics capex was just peanuts. In Q2 of 2020, Amazon spent $12 billion on cash capex but the majority of that was related to AWS. So let’s say even $3 billion was capex for fulfillment, that was 75x the amount that Shopify was prepared to spend per quarter. So yeah, peanuts.

And that’s the real question that sort of remains today. Is the convenience that Amazon has conditioned us all to expect the overriding success factor in e-commerce?

Companies like Pinduoduo’s Temu and Shopee in Brazil are counterpoints to this as their bet is low prices outweigh the emotional cost of waiting a few weeks for your shipments. That might work in lower GDP countries but it’s hard to imagine it working super well in the US. We’ve already seen how Wish failed spectacularly. It’ll be very interesting though. Temu has routinely been at the top of the app charts in the US so I’m keeping an open mind.

With that said, where does Shopify fit into the rapidly shifting e-commerce landscape these days? Since the company’s inception, the thing it has been best at is creating great software. Logistics was, in Lutke’s words, a “side quest” and now that the company cut 20% of its workforce, divested the two logistics acquisitions, and gotten to free cash flow positive, they are much more in control of their destiny. Without the distraction of logistics they can focus on software and payments. There is still plenty of whitespace for individual online stores. Companies care too much about their brand to have everything run through Amazon. Amazon’s moat has become disproportionately larger compared to Shopify since COVID, which wasn’t a no-brainer prediction, though it seems that way in retrospect. Shopify is still growing faster than 20% with a strong balance sheet, a narrower focus and GAAP profitability on the horizon. Just because it can’t compete with Amazon’s logistics fortress doesn’t mean the company has no worth. It still has a large and growing segment of large merchants that are willing to use Shopify and the company has very strong pricing power. The switching costs are ridiculously high after building out an entire e-commerce operation using Shopify.

Tobi has gotten some flack for really focusing on crypto and now he’s all in on AI. I don’t think he’s just a trendy follower. I think he loves technology and thinks deeply about the future. There will be booms and busts but I do think there is real value in both of these technologies over the very long term. I know many people will disagree on the crypto stuff but time will tell.

Shopify is back to being focused on its original mission which is to arm the rebels. The one weapon the rebels won’t really be armed with though is logistics. And maybe that’s okay.

We’ll end with the same fun fact:

Shopify was first called Jaded Pixel Technologies, but later changed its name:

If you enjoyed this, please turn that ♡ into a ♥️. This will help others find this newsletter. Thank you so much 😁

What Else We Offer

For self-directed investors: Dynasty Membership

Long-biased fund: Infuse Partners (intro call)

More content (The Investing City Podcast, online course, and blog)

If you’re interested in advertising, just fill out this form