If you enjoy Business Breakdowns, check out The Investing City Podcast. Our goal is to help you improve at investing, business, and life: learn from some of the brightest minds in business such as the CEO of Walmart, Morgan Housel, or billion-dollar fund managers.

We are starting a sector breakdown series and the first episode is semiconductors so after you read through this post and listen to this podcast episode, you’ll have a decent sense of the semi landscape. You can also listen with transcripts here. Below is the full episode, which is a sneak peek for subscribers since it is officially released in two days.

Now, on to your regularly scheduled programming — learn about TSMC, one of the most important companies in the world.

Taiwan Semiconductor Manufacturing Company (TSMC) is the world's largest contract semiconductor manufacturer. Founded in 1987 by Morris Chang in Hsinchu, Taiwan, TSMC has a market share of over 50% and a customer base that includes some of the biggest names in the industry, such as Apple, Qualcomm, and Nvidia. Mr. Chang, now 92 years old, worked at Texas Instruments for 25 years and pioneered the controversial-at-the-time pricing scheme called “ahead of the cost curve.” The idea was to price new chips at lower margins to get more volume which would lead to higher yields and, in turn, higher margins. TSMC has built its business off of this idea and now the moat is so large, it would be challenging to catch up.

TSMC's primary business is the production of semiconductor chips for its customers. The company operates a number of fabrication facilities, or "fabs," where it uses advanced manufacturing processes to produce chips on a mind-blowingly large scale. One of the key strengths of TSMC's business model is its focus on customer service and support. The company has a dedicated customer support team that works closely with its customers to understand their needs and help them optimize their chip designs. TSMC also offers a range of value-added services, such as packaging and testing, to help its customers get their products to market quickly and efficiently. For example, Apple’s M2 chips are produced by TSMC and the integration process with Apple’s designs is very tight.

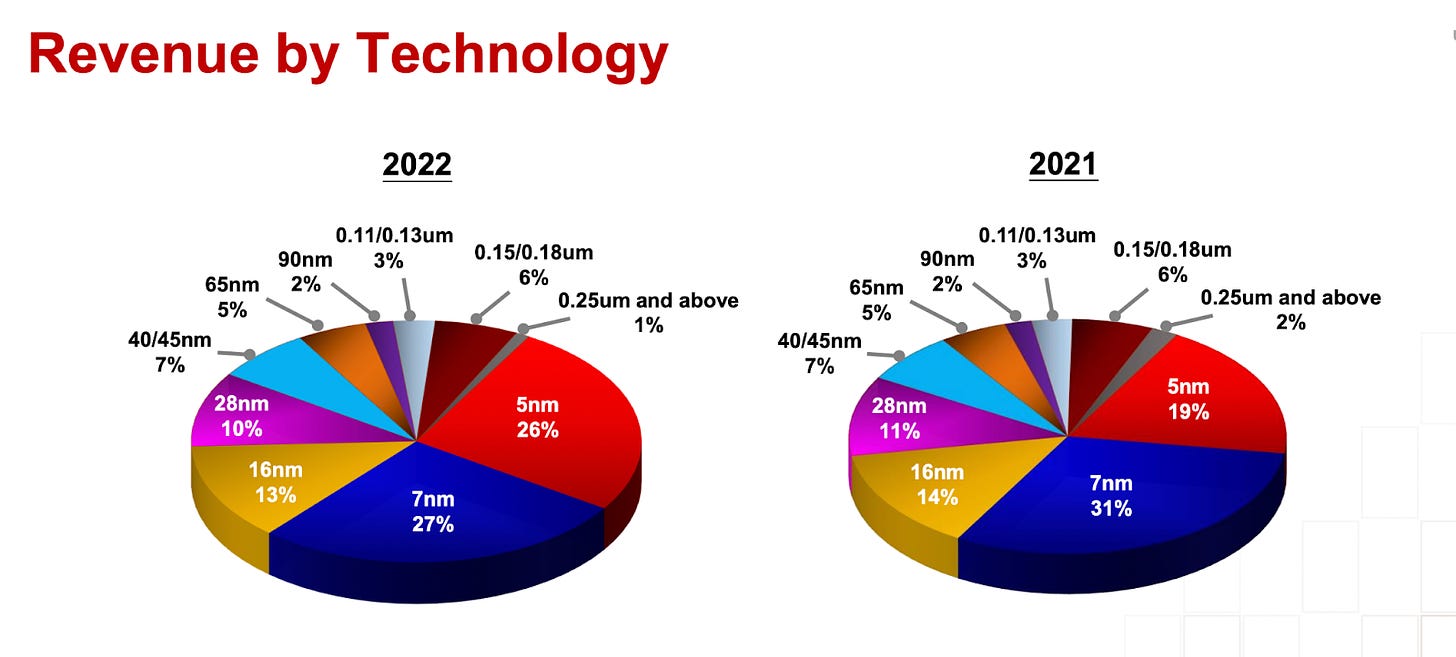

One of the key advantages of TSMC's business model is its focus on contract manufacturing. Rather than designing and selling its own chips, the company provides manufacturing services to customers who design and market their own chips. This allows TSMC to focus on its core competencies in chip manufacturing while providing customers with access to the company's advanced technology and production capabilities. The company's production capabilities are highly sought after, as it is one of the few manufacturers with the technology and capacity to produce chips using advanced manufacturing processes, such as 7nm (nanometer) and 5nm. More customers are looking to move to 5nm as more transistors can be placed on the chip, meaning better overall performance.

Looking forward, TSMC is well-positioned to continue its growth, as the demand for semiconductor chips is expected to remain strong. The company is investing heavily in R&D to develop new technologies and production processes, and it is expanding its manufacturing capacity to meet the growing demand for chips. Additionally, TSMC is exploring new growth opportunities, such as the production of chips for AI and IoT (internet of things). Management recently said chips for AI would grow 5x over the next 5 years.

Of course, there are also some risks and challenges that TSMC will need to navigate in order to continue its growth. One key risk is competition from other semiconductor manufacturers, both contract manufacturers and chipmakers that produce their own chips. However, the thing that TSMC really has going for it is specialization. It just doesn’t make sense for Apple to create its own fab. It doesn’t specialize in that so it would take years for the investment to be worthwhile. And those dollars would likely be better spent elsewhere, where the company actually has a core competency. So there’s a real opportunity cost there.

But speaking of Apple, it makes up 26% of TSMC’s revenue. That means Apple spends about $20 billion with TSMC. However, Apple’s cost of goods is $220 billion. So TSMC only makes up ~10% of Apple’s COGS despite how crucial the chips are in the product. And TSMC is only getting more of Apple’s business. Up until the iPhone 6S, Apple would split manufacturing duties between the big 2, Samsung and TSMC – just for the sake of supplier diversification. Since then, TSMC has won nearly all of Apple’s business; iPhones, iPads, and Mac. TSMC is just pulling ahead technologically. After all, they’re spending about $35 billion in capital expenditures annually to make sure their customers are happy whereas Samsung has many other business lines.

Additionally, the company will need to manage geopolitical risks, as the global semiconductor industry is subject to trade tensions and other political factors. If China ever invades Taiwan, the market would go berserk and TSMC’s stock could probably be down more than 40%. I can’t even really play out the picture if China were to take over Taiwan but I know it wouldn’t be good. This is likely the main reason why the stock only trades for 12x EBIT and 25x FCF. This is the main risk that investors need to get comfortable with here. Last August, TSMC’s current CEO, Mark Liu, said that the company would be “inoperable” if China waged a war. I guess the question you’d then have to ask is what does that do to the terminal value of the company? How long would it be inoperable? What would the end state of a Chinese-controlled Taiwan look like? How would China deal with TSMC? Would TSMC be allowed to just build more fabs in the US? How long would that take? What would the US do if China invaded? There are clearly a lot of questions that are unanswerable at the moment. I guess the way that makes sense is assigning a probability to the long-term terminal value destruction and seeing if that discounts the upside in the stock enough that it doesn’t make sense. I’m not going to go through that exercise here but it’s probably the main thing that matters since I think the stock is clearly undervalued for the size of its moat and the importance of the product it creates. Right now, TSMC has 12 total fabs operational, 2 of them being in the US under subsidiaries and then the Phoenix plant should be ready shortly. A China invasion would do serious damage but there is also a non-zero chance that TSMC would be able to continue operating. Right now, there are many questions. But if you can get comfortable with that risk – because let’s be honest, if that actually did happen everything tech related would be down a ton. TSMC would be down more but we have more serious issues if an invasion actually does occur.

In conclusion, TSMC is a leading player in the global semiconductor industry, with a strong business model and impressive financial performance. The company's focus on contract manufacturing and its expertise in advanced chip production technologies give it a competitive advantage and its investments in R&D and capacity expansion position it well for future growth. While there are clear risks and challenges, TSMC's track record suggests that it is well-positioned to continue its success and drive value for shareholders. I’ll end with this incredibly impressive stat that reveals the company’s dominance: 92% of 10nm or smaller chips are made by TSMC. And chips are only getting smaller as computing needs increase, especially considering the explosion in AI. The company is a dominant force in the global economy and nearly all of the digital products and services we use today wouldn’t be possible without TSMC.

Thanks for reading! Check out our podcast if you enjoyed this!

A good quick overview that I linked to in today's post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-18-2024

I think there are many other interesting and overlooked stocks in Taiwan that TSMC overshadows though...

Great interview