If you haven’t already, join 9,525 other business lovers and subscribe for free:

Today’s post is sponsored by Stratosphere.io. It’s a financial data platform that we use and it’s awesome for gathering and visualizing financial data for any company you’re researching.

Get started researching on the Stratosphere.io platform today, for free. And you can use the promo code: investingcity for 25% off your first year.

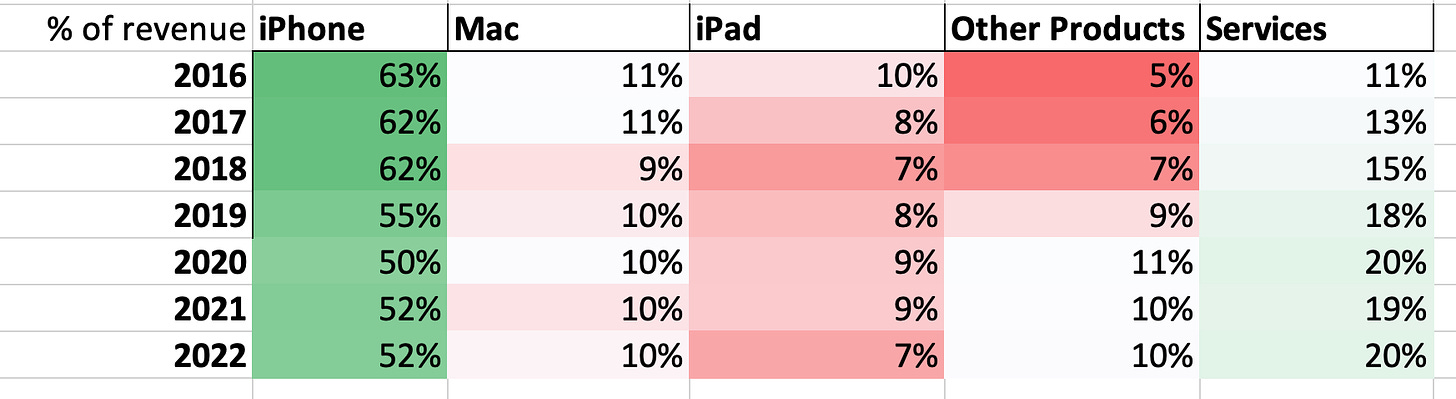

Apple’s revenue is broken up into five segments:

iPhone

Mac

iPad

Wearables, Home and Accessories

Services

The first three segments don’t need much explanation but here’s some more detail on the last two.

The two biggest drivers for this segment (Wearables aka “Other Products”) are likely AirPods and the Apple Watch.

Analysts estimate that the company sold nearly 80 million AirPods last year, and at an average selling price of $160 a pop, that translates into $12.8 billion, or a third of this segment’s revenue. Further, this could actually be a low estimate because the AirPods Pro will skew the average selling price upwards. Not many other companies on Earth could charge $250 for two small pieces of plastic.

Moving to the “Services” segment…

This segment is very interesting because Apple has such a large installed base. In fact, at the last count, the company had sold well over 2.2 billion iPhones and currently has an active installed base of about 1 billion. Add in millions of Macs and iPads and you’ve got a HUGE base of people to sell into. So those first three revenue segments (iPhone, Mac, and iPad) enable the company to sell more services, which increases the stickiness of the ecosystem.

And the services have gross margins that are twice as high as the products, at 72% vs. 36%.

Further, here is exactly how the revenue breaks down between these five segments (the colors indicate the trend as an overall percentage of revenue).

You can see that the iPhone is shrinking a little as a proportion of sales but it still makes up the majority. This decline has been offset by the “Other Products” and “Services” segments.

But the company still heavily relies on the success of iPhone sales. This is why it was a bit disconcerting that Apple stopped releasing individual iPhone unit sales in November of 2018, which coincided with a revenue drop-off.

Coincidence? I think not.

And this wasn’t the best timing as the markets were having a mini-meltdown in late 2018. So the company lost more than $350 billion in value.

But now the narrative has changed quite drastically. Wearables and services are growing more quickly and the company has been incredibly shareholder-friendly. These two revenue segments are growing nicely. Though they still only make up about 30% of overall revenue, my best guess is that they contribute about 40-45% of gross profit because of the higher margins. In this light, Apple isn’t as reliant on the iPhone as it once was. The iPhone still acts as a central feature of everything else — somebody wouldn’t order an Apple Watch without having an iPhone — but it goes to show that Apple is doing a great job of monetizing its huge installed base and taking advantage of its brand equity and cohesive hardware/software ecosystem.

Moreover, the company has returned a lot of its excess capital back to shareholders.

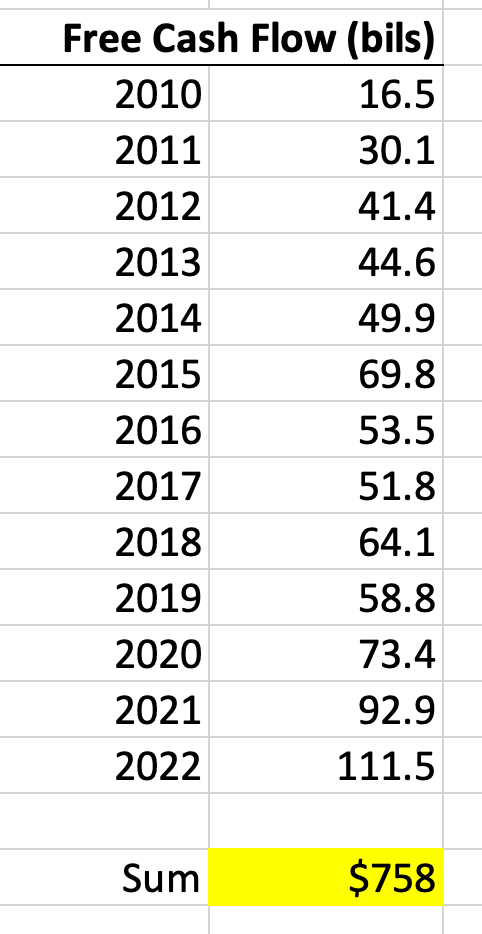

Over the last 13 years, Apple hauled in over a quarter trillion in free cash flow ($758 billion to be exact).

Out of this $758 billion, the company returned 93% of it to shareholders.

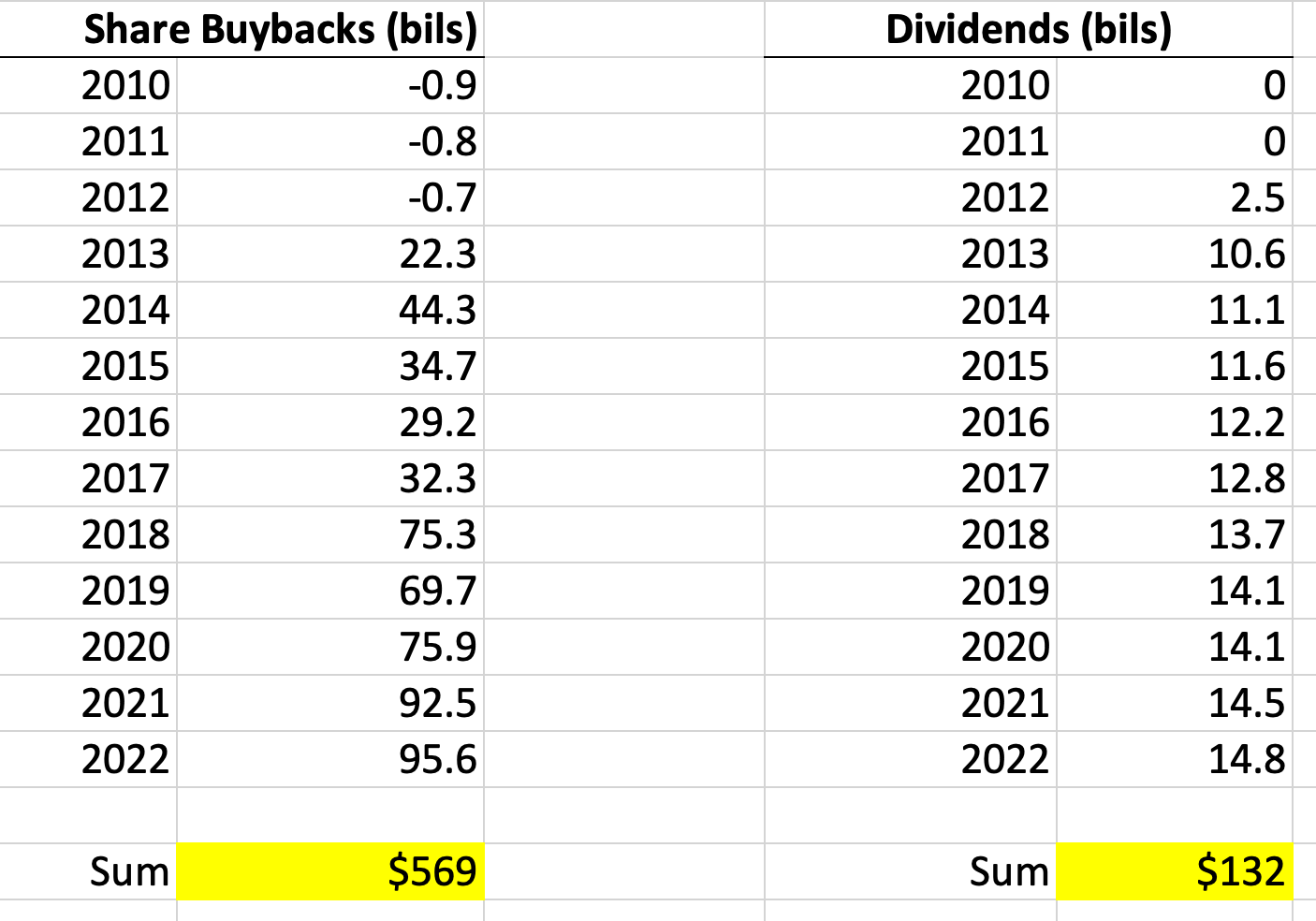

Since 2010, Apple has paid out $132 billion in dividends and bought back a whopping $569 billion of its own stock.

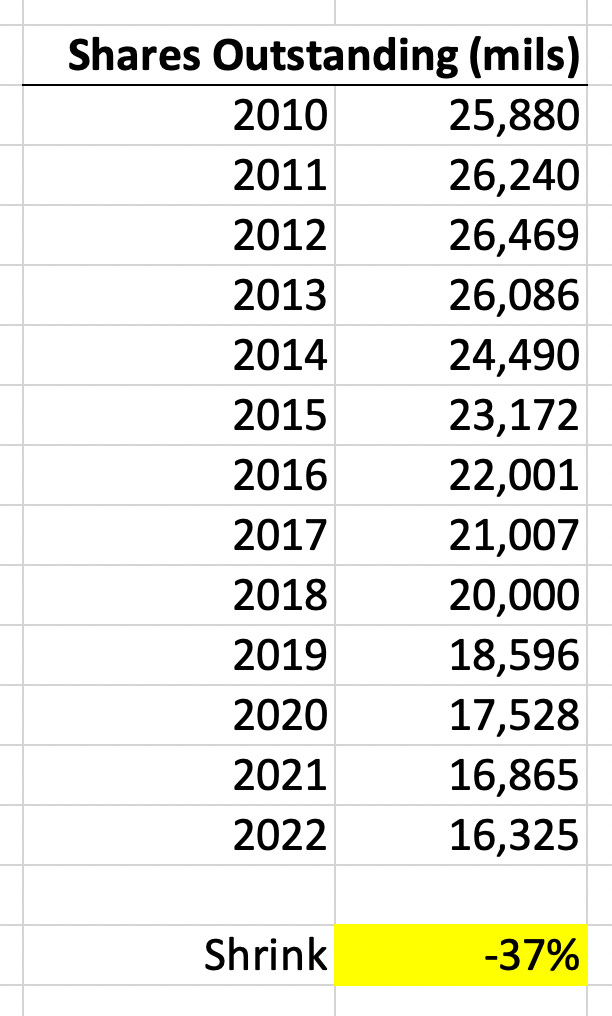

This has allowed the company to shrink the overall diluted share count by 37%.

Before ending, there are a few more interesting things about Apple.

First, despite its retail presence, the company only does about 38% of its revenue from direct to consumer distribution. The other 62% comes from carriers (Verizon) and resellers (Costco/Amazon). The direct distribution is actually up from about 30% just a few years back.

Second, the company has a negative cash conversion cycle. For a retailer to have a negative cash conversion cycle is nearly unheard of. In perspective, Costco’s is 4 days. This is mainly a function of how much leverage Apple has against its suppliers. Getting an Apple contract is so game-changing for nearly any supplier, that Apple can basically set the payment terms.

To break the cash conversion cycle into its components, Apple typically turns over its inventory every 9 days so it likely runs a just-in-time supply chain process. This means the company doesn’t hold much inventory at all, which is unsurprising given that CEO, Tim Cook, is a supply chain guy.

Further, the company gets paid back by customers in about 2 months. But here’s where Apple really flexes its muscle. It pays back suppliers, on average, in about 104 days.

So when you go to an Apple store to buy an iPhone, the company hasn’t paid its suppliers yet for those phones. If you buy full-price in the store, Apple will pay cash for the cost of that phone about 3 months later.

Hence the beauty of a negative cash conversion cycle. Get paid up-front and then pay suppliers back at a later date. This decreases inventory and working-capital risk and actually gives the company a nice float to work with.

This also shows just how much leverage the company has over its suppliers. Sure, there may be some suppliers that make specialized parts where Apple needs to pay them more quickly, but the numbers show that suppliers don’t have much negotiating-power against the creator of the iPhone.

Thanks so much for reading! We appreciate you!

If you enjoyed this, please consider pressing that ♡ below to make it ♥️. This will help other readers find this newsletter.

What Else We Offer

Our full-service research offering: Dynasty Membership

Our accredited investor long-biased fund: Infuse Partners (intro call)

More Investing City content (The Investing City Podcast, blog, videos, etc.)

Apple Services is really the growth story for Apple now and is already so big

(for comparison sake, $78.1B is already higher than entire global revenue of Nike and McDonalds combined) - I know different industries but gives you a perspective on scale.

As you rightly pointed out - its the massive leverage of a premium installed base which is high margin.

Given the seriousness with which Apple is moving into advertising, there are good reasons to believe further upside in the stock long term